Yala Mainnet: Overview

Yala is a native Bitcoin liquidity protocol that channels BTC into yield opportunities across DeFi and RWAs without giving up ownership of their assets.

On Yala Mainnet, users can mint $YU, gain yield through staking or providing liquidity, bridge assets between Ethereum and Solana, and earn rewards by actively engaging with the protocol.

What You Can Do on Yala

Mint $YU: Deposit BTC via MetaMint or convert USDC 1:1 through the Convert feature

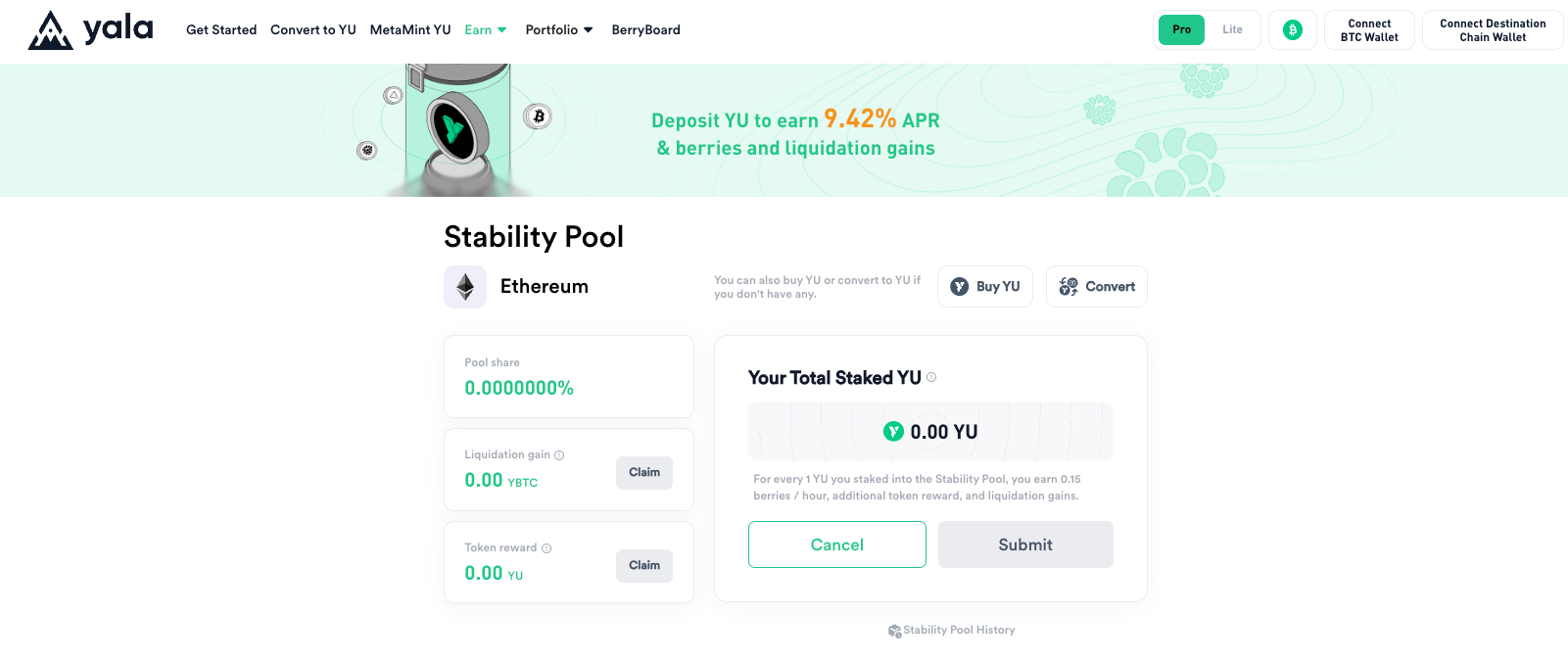

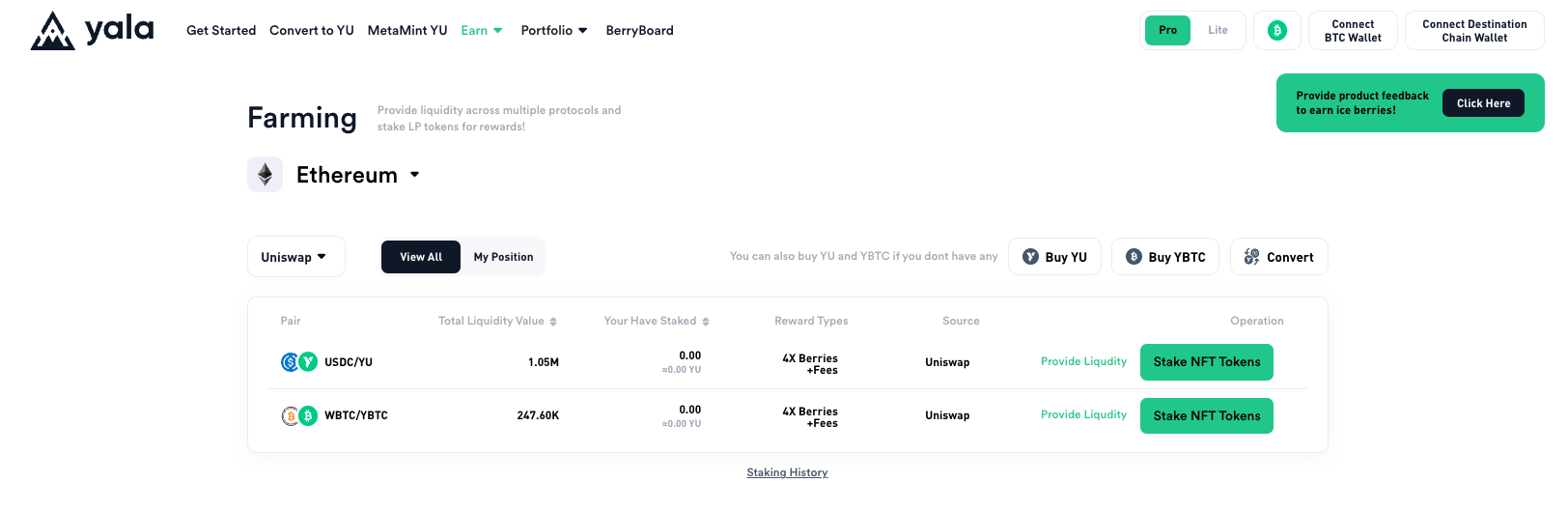

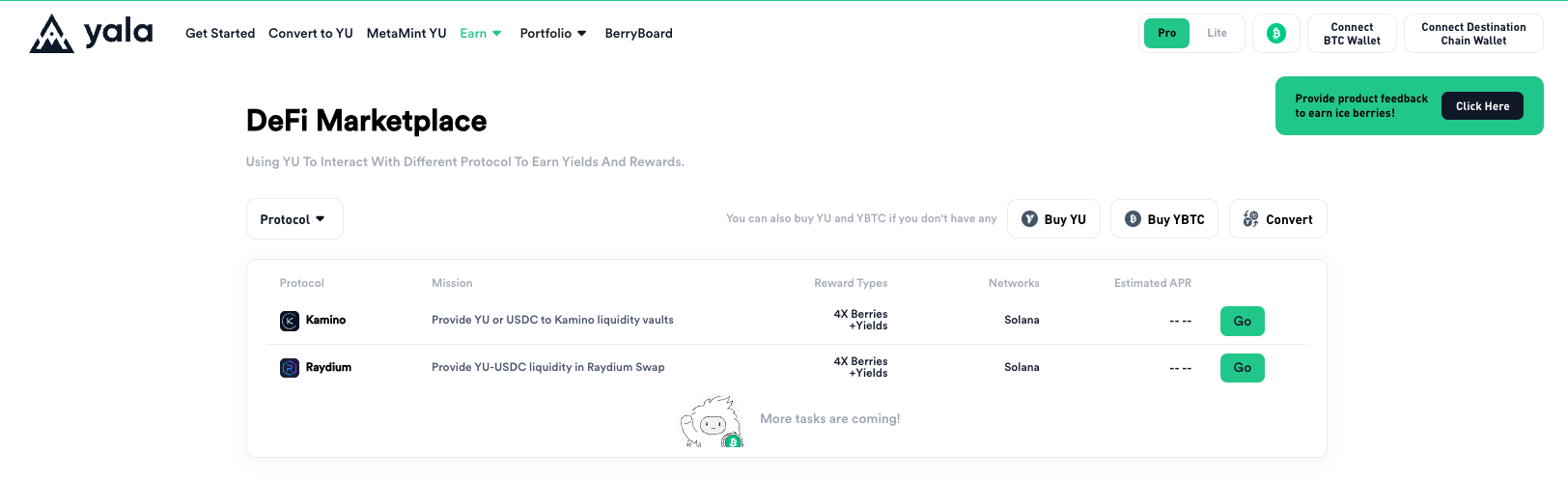

- Earn yield: Stake $YU in the Stability Pool, provide liquidity on Uniswap V3, or access third-party strategies via the DeFi Marketplace

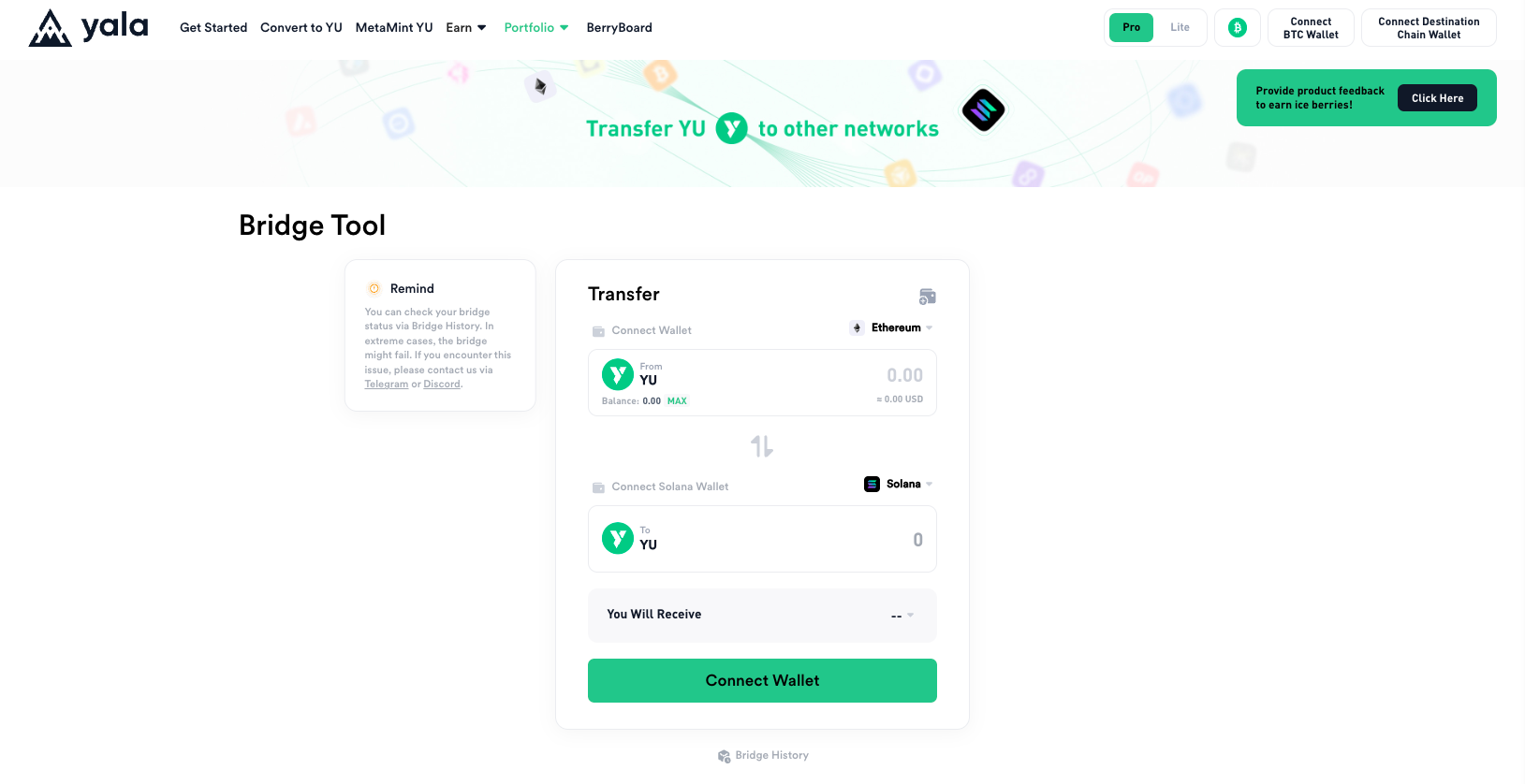

- Bridge assets: Use the bridge tool to transfer $YU between Ethereum and Solana

- Track your assets: View and manage all your vaults, positions, and rewards on the Portfolio page

- Earn Points (Berries & Ice Berries): Earn through both on-chain actions and off-chain engagement. Ice Berries are converted into Berries on mainnet and together they determine your airdrop eligibility.

Security & Transparency

Yala is built on 3 foundational pillars:

- Bitcoin-Native Security: BTC never leaves the Bitcoin blockchain, eliminating custodial risk

- Institutional-Grade Yield: Tap into real-world yield opportunities managed by professionals - opportunities that are traditionally gated to institutions or high-net-worth individuals.

- Transparent Risk Management: All strategies are backed by on-chain collateral and auditable performance. No black boxes. No surprises.

Getting Started on Yala Mainnet

- Visit app.yala.org

- Connect your BTC and destination chain wallets

- Use MetaMint to deposit BTC and mint $YU

- Earn yield through the Stability Pool, Farming, or curated strategies in the DeFi Marketplace

Need more guidance? You can always refer to our full documentation here: https://docs.yala.org

Join the Yala Community

Yala is a native Bitcoin liquidity protocol that channels BTC into yield opportunities across DeFi and RWAs.

Bitcoin holders unlock capital through self-custodial, liquidation-free borrowing by minting $YU, a BTC-backed liquidity asset. In this process, they pay a stability fee directly to $YU depositors, effectively exchanging BTC-backed exposure for portable, capital-efficient liquidity and access to yield without giving up ownership.

Yala’s SmartVault module manages system risk and ensures efficient yield distribution.