$YALA Is Here: Tokenomics & Distribution

Introducing $YALA, the native token of the Yala protocol.

Yala was built with a bold but clear vision: to unlock Bitcoin's untapped liquidity and bring it to work across DeFi and the real world use cases. Now, that vision comes full circle with the introduction of $YALA, the native token of the Yala protocol.

In this post, we explore the role of $YALA, its tokenomics, and how it empowers Yala’s long-term roadmap.

What Is $YALA

$YALA is the governance and utility token that powers the Yala ecosystem. It plays three critical roles:

- Incentivizing participation

- Securing protocol infrastructure

- Enabling decentralized governance

As the Yala grows, $YALA will work to anchor protocol stability, decentralize governance decisions, and align incentives across the ecosystem.

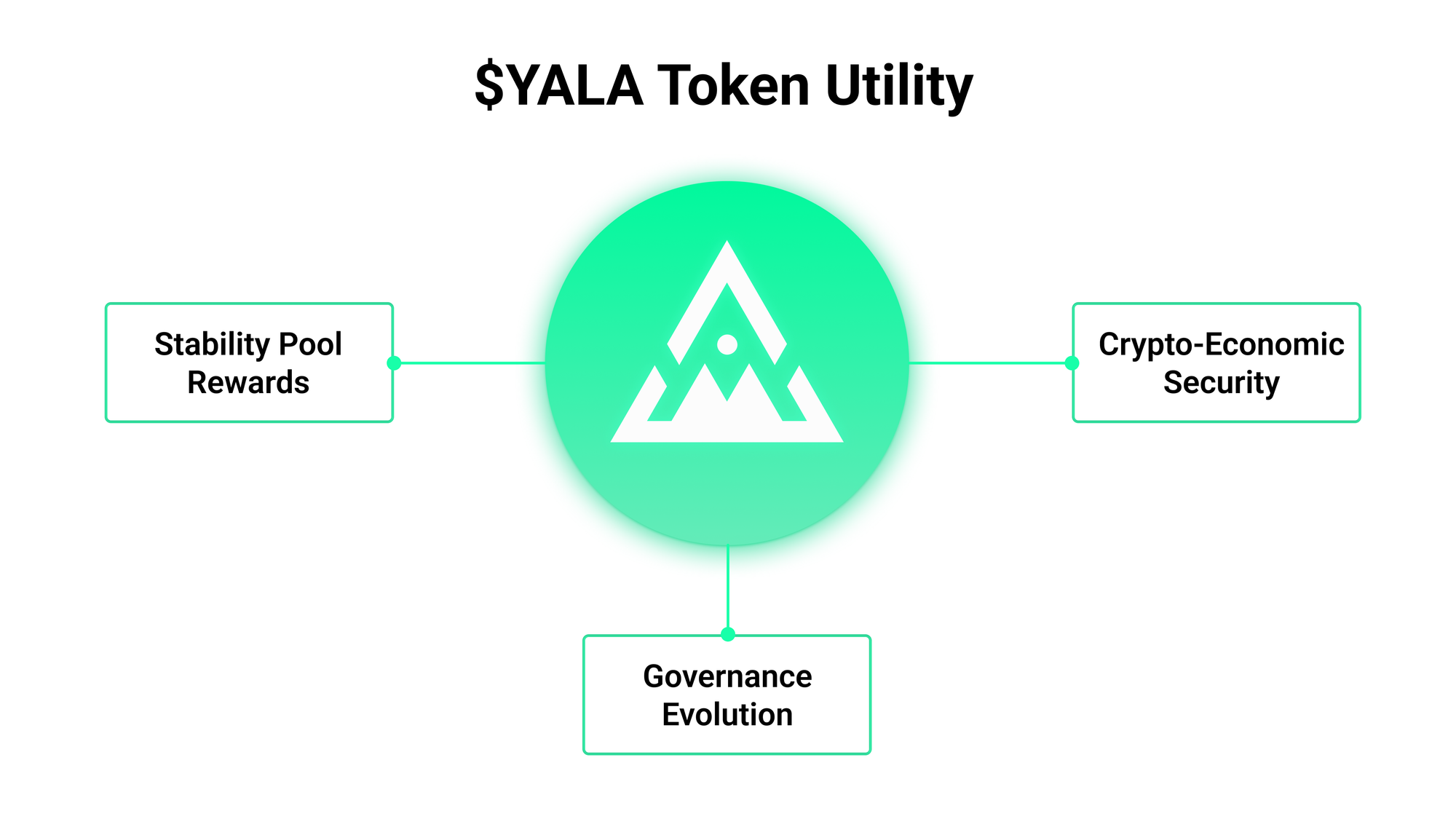

Token Utility

$YALA is designed with the following core utilities:

- Stability Pool Rewards: $YALA plays a central role in Yala's risk management framework. Users can deposit $YU into the Stability Pool to help absorb system debt during liquidations. In return, they earn $YALA rewards, a share of liquidation collateral, and stability fees.

- Cryptoeconomic Security: $YALA enhances protocol security through staking. Token holders stake $YALA to validator nodes within the Notary Bridge cross-chain system and help safeguard the $YU stablecoin via LayerZero-powered Decentralized Verifier Networks.

- Governance Evolution: As the protocol decentralizes, $YALA becomes a governance asset. Holders participate in protocol decision-making by voting on parameters, submitting improvement proposals, and locking tokens as $veYALA to influence gauge weights and direct emissions and incentives.

By powering security, incentives, and governance, $YALA empowers the community to shape and sustain the Yala ecosystem.

Token Distribution Overview

Total supply: 1,000,000,000 $YALA (fixed)

The total supply of $YALA is designed to ensure long-term sustainability and alignment between all stakeholders in the Yala ecosystem.

Distribution Breakdown:

1. Investors (15.98%)

Allocated to early strategic partners and backers who provided capital, guidance, and long-term alignment with Yala’s vision.

Vesting Schedule: 1-year cliff, followed by 18-month quarterly vesting.

2. Ecosystem & Community (20%)

Incentivizes core participants in the Yala ecosystem, including $YU liquidity providers, active users, and strategic partners.

Vesting Schedule: 45% unlocked at TGE; remaining 55% released linearly over 24 months.

3. Foundation & Treasury (29.12%)

Managed by the Yala Foundation, this reserve ensures long-term sustainability and protocol efficiency - including liquidation mechanisms and system security. It also supports ongoing development, contributor grants, strategic partnerships, security audits, and operational resilience. Additionally, it acts as a buffer for recapitalization or emergency intervention during protocol stress events.

Vesting Schedule: 30% unlocked at TGE; 1-year cliff, followed by 36-month linear vesting.

4. Marketing (10%)

Focused on growth and brand awareness through user acquisition campaigns, educational initiatives, and cross-industry collaborations. This allocation supports influencer engagement, regional expansion, co-marketing efforts, and event sponsorships.

Vesting Schedule: 20% unlocked at TGE; 1-year cliff, followed by 24-month linear vesting.

5. Team (20%)

Reserved for founders, developers, researchers, marketers, operations and core contributors who work underpins the protocol’s architecture, growth and security. It is designed to encourage long-term commitment and align incentives with sustainable development.

Vesting Schedule: 1-year cliff, followed by 24-month linear monthly vesting.

6. Airdrop (3.4%)

A one-time distribution to early adopters, testnet and mainnet participants, and users who contributed meaningfully to the Yala and Yeti Footprints programs.

Vesting Schedule: Fully unlocked at TGE.

See full airdrop rules here: https://blog.yala.org/yala-season-1-airdrop-rules-overview/

7. Market Makers (1.5%)

Allocated to support exchange liquidity, enabling tight spreads, low slippage, and efficient trading on both CEXs and DEXs. Distributed through contractual agreements with professional market makers to enhance token velocity and price discovery.

Vesting Schedule: Custom, subject to terms negotiated in market-making agreements.

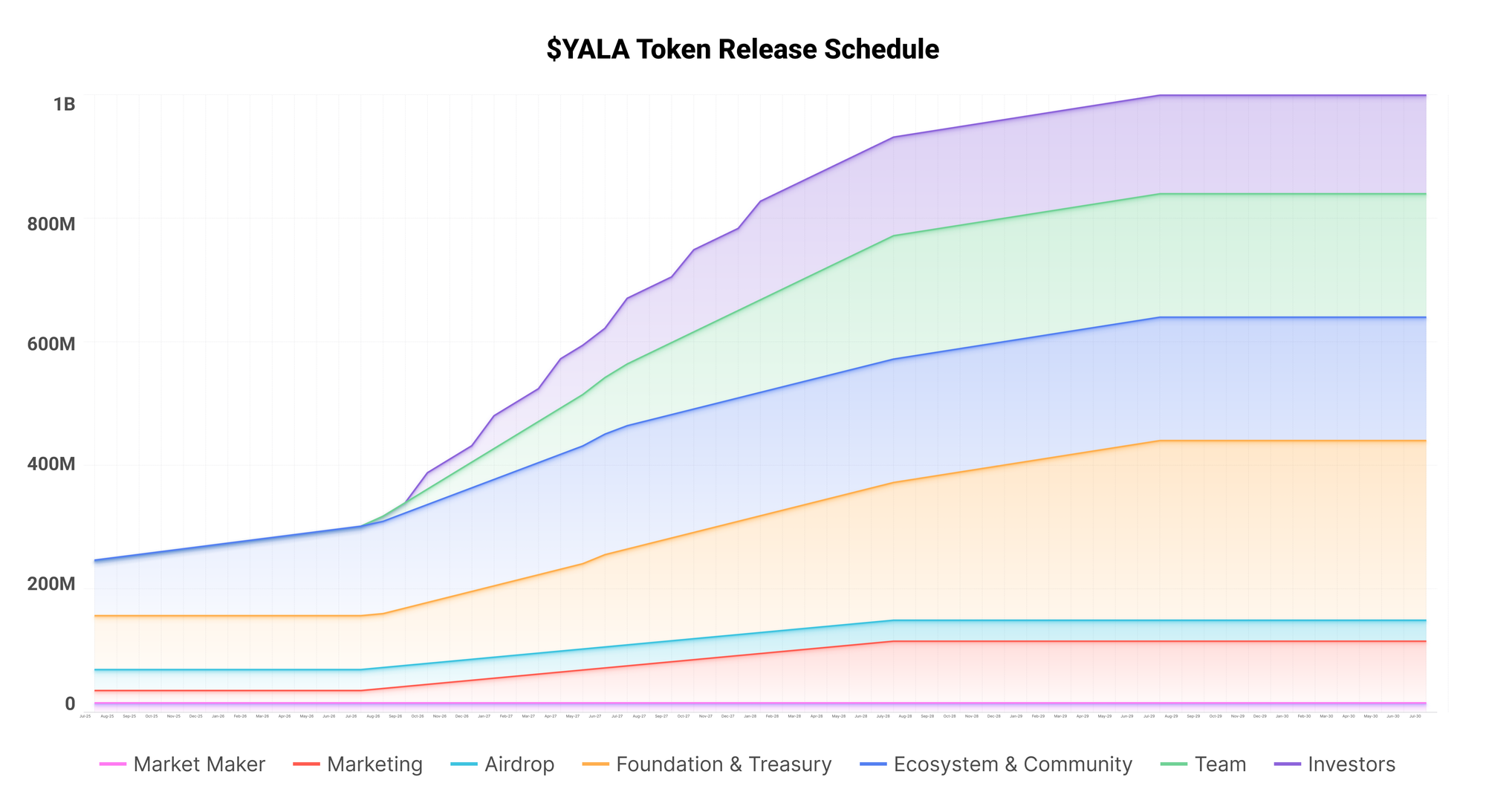

Token Release Timeline

The release of $YALA is structured to prioritize long-term alignment and support sustainable ecosystem growth.

- Year 1: Airdrops and initial ecosystem allocation go live. Team and investor tokens remain locked. Marketing and Foundation partially unlocked at TGE to support growth.

- Year 2: Unlocking begins for investor and team allocations, following their respective cliffs. Vesting continues for Marketing, Ecosystem, and Foundation allocations.

- Year 3 and beyond: The majority of tokens enter circulation. Treasury distributions proceed strategically based on evolving ecosystem needs, protocol development, and governance input.

Governance Framework

Yala governance is structured across three proposal tiers:

Delegation is supported, allowing token holders to assign voting power to trusted community members, experts, or automated strategies.

Ecosystem Growth

Treasury funds will be deployed strategically to support long-term ecosystem expansion to grow Yala’s reach and utility.

Key initiatives include:

- $YU Liquidity Bootstrapping

- $YALA Trading Pair Incentives

- Cross-chain Infrastructure Grants

- Developer Funding (integrations, tools, audits)

- Community Rewards (bug bounties, ambassador incentives, governance participation)

Built for Sustainability

Yala is designed to balance token incentives with long-term system health:

- Controlled token vesting prevents supply shocks

- Protocol fees create buy pressure for $YALA

- Expanding utility ensures real, organic demand

- Strategic reserves provide liquidity and resilience in volatile markets

The Road Ahead

The $YALA token is central to Yala’s mission: building a decentralized, Bitcoin-backed liquidity system that is scalable, secure, and self-sustaining.

With a thoughtfully constructed token model, decentralized governance, and a growing community of builders and users, $YALA is a coordination layer for the future of permissionless credit.

Welcome to the era of $YALA.

Join the Yala Community

Yala is a native Bitcoin liquidity protocol that channels BTC into yield opportunities across DeFi and RWAs.

Bitcoin holders unlock capital through self-custodial, liquidation-free borrowing by minting $YU, a BTC-backed liquidity asset. In this process, they pay a stability fee directly to $YU depositors, effectively exchanging BTC-backed exposure for portable, capital-efficient liquidity and access to yield without giving up ownership.

Yala’s SmartVault module manages system risk and ensures efficient yield distribution.