Introducing Yala 2.0: AI-Native Fair Value Agent for Global Prediction Markets

Yala is evolving into an AI-native fair-value agent that provides reliable probability signals for prediction markets worldwide.

Today marks the beginning of a new chapter for Yala, a future dedicated to solving prediction markets’ missing piece: a reliable, accessible fair-value signal.

Yala’s new AI-native fair-value agent is designed to improve predictive accuracy and make advanced probabilistic tools accessible to all users. This roadmap highlights Yala’s evolution into a scalable fair-value engine powered by modular AI components and data-driven probability models, ultimately expanding the system’s reach across more markets, domains, and application scenarios.

TL;DR

Yala is evolving into an AI-native fair-value agent that provides reliable probability signals for prediction markets worldwide.

Prediction markets are efficient but incomplete, they lack a systematic, high-accuracy fair-value reference, creating information inequity and inconsistent pricing.

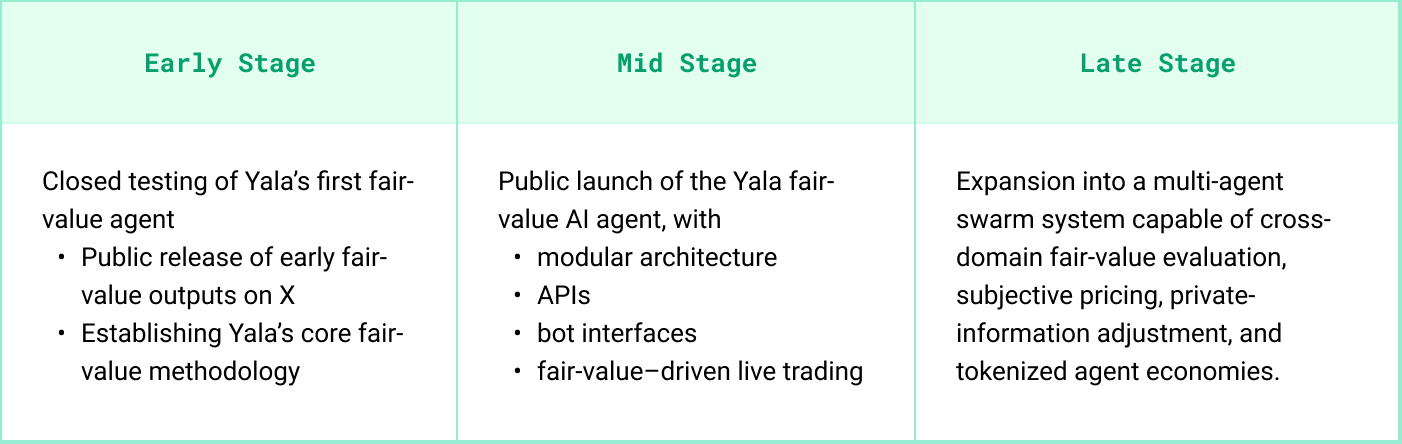

Yala introduces a new staged roadmap:

- Early Stage: Closed testing of Yala’s first fair-value agent, public release of early fair-value outputs on X, establishing Yala’s core fair-value methodology.

- Mid Stage: Public launch of the Yala fair-value AI agent, with modular architecture, APIs, bot interfaces and fair-value–driven live trading (a prediction-market version of Alpha Arena).

- Late Stage: Expansion into a multi-agent swarm system capable of cross-domain fair-value evaluation, subjective pricing, private-information adjustment, and tokenized agent economies.

Yala is building toward a future where fair-value AI agents form the probabilistic backbone of global prediction markets, enabling agents, markets, and users to coordinate on accurate, verifiable fair-value signals.

The Problem: Prediction Markets Lacks Fair Value Signals

Prediction markets are rapidly becoming one of the world’s most important mechanisms for pricing information. Take the 2024 U.S. presidential election as an example: while major polling agencies showed Trump and Harris in a statistical dead heat, the Polymarket odds strongly favored Trump throughout. As prediction markets mature, few now doubt their ability to surface real-time collective intelligence and price uncertainty more efficiently than traditional systems.

At the regulatory level, this shift has already been recognized. Kalshi’s approval by the Commodity Futures Trading Commission (CFTC) as a Designated Contract Market (DCM) confirms that prediction platforms are no longer treated as gambling venues, they are a distinct class of financial infrastructure. The fundamental reason is simple: their prices are no longer set by bookmakers but determined through order-book matching, where traders negotiate prices that directly represent probabilities.

In many ways, prediction markets resemble options markets. Anyone with experience in derivatives understands the importance of fair-value models, such as Black–Scholes, for pricing and risk management. Prediction markets, however, currently lack an equivalent framework. If they are to evolve into serious financial products, a robust fair-value model is indispensable.

For individual market participants, the implications are profound. The trader who can more rationally and accurately assess true probabilities is the one who consistently discovers valuable opportunities in the sea of uncertainty. Fair value acts as the “North Star,” guiding users toward statistically favorable decisions.

Yet in practice, calculating fair value is hard. Whether forecasting asset prices, sports outcomes, or political events, results depend on many interacting variables far beyond human cognition. Unlike options, prediction markets cannot rely on a single elegant equation. This is precisely where AI agents show unique advantages: they can integrate complex signals, update dynamically, and output a probability, a fair price for “Yes.”Prediction markets need a fair-value intelligence source, and that’s where Yala comes in.

In practice, the use of fair value is simple and intuitive.

- When the fair value of an event is higher than the market price of “Yes,” a bettor is statistically better off buying Yes or selling No.

- When the fair value is lower than the market price, the opposite is true, selling Yes or buying No becomes the more rational position.

Fair value does not guarantee perfect accuracy, but it consistently improves a user’s decision quality and long-term win rate in probability-based markets. It serves as a north star for navigating uncertainty, turning prediction markets from pure speculation into structured information-pricing systems.

The Yala Roadmap: Building Fair Value, Stage by Stage

Yala’s evolution is grounded in a clear, multi-stage roadmap, each phase deepening intelligence and expanding the design space for what prediction markets and AI agents can become.

Early Stage: Establishing the First Fair-Value AI Agent

In the early stage, Yala will focus on releasing a steady and reliable stream of probability estimates across key prediction categories. The Yala AI Agent will be launched in a closed, internal testing phase, allowing rapid iteration ahead of the public launch. During this period, Yala will not only continue advancing the training and refinement of our first fair-value AI agent, but will also use the official X account as the primary channel for sharing early fair-value outputs.

These initial releases are intended to showcase the direction of Yala’s fair-value methodology, how the system approaches calibration, consistency and probabilistic reasoning. As internal development continues, these early signals help lay the foundation for more advanced capabilities that follow in later stages.

Mid Stage: The Public Launch of Yala’s Fair-Value AI Agent

As the system matures, Yala moves from private beta to the public launch of its first fair-value AI agent, a specialized model designed for price prediction markets and risk-neutral valuation. This phase marks Yala’s transition from publishing raw forecasts to operating a verifiable, measurable agent whose performance is continuously tested in real markets.

At this stage, the agent relies primarily on historical trading data as the foundational signal source for generating risk-neutral fair-value estimates, while also incorporating complementary signals such as news-driven event analysis, smart-money tagging information, and social-media-based sentiment dynamics to enhance its contextual awareness and responsiveness.

Users interact with the agent through a simple, structured input format:

- Market type: sports events or crypto markets

- Target condition: target price, direction, or price range

- Time horizon: a specific future timestamp

Based on these inputs, the agent outputs a probability estimate representing the likelihood that the specific condition will be met. This becomes the user’s fair-value reference for directional or range-based trading decisions.

In the mid stage, Yala will showcase the agent operating in a small live environment, managing between $1,000–$10,000 in real positions and executing trades autonomously. The goal is to validate the agent’s fair-value logic in real markets while maintaining controlled risk limits.

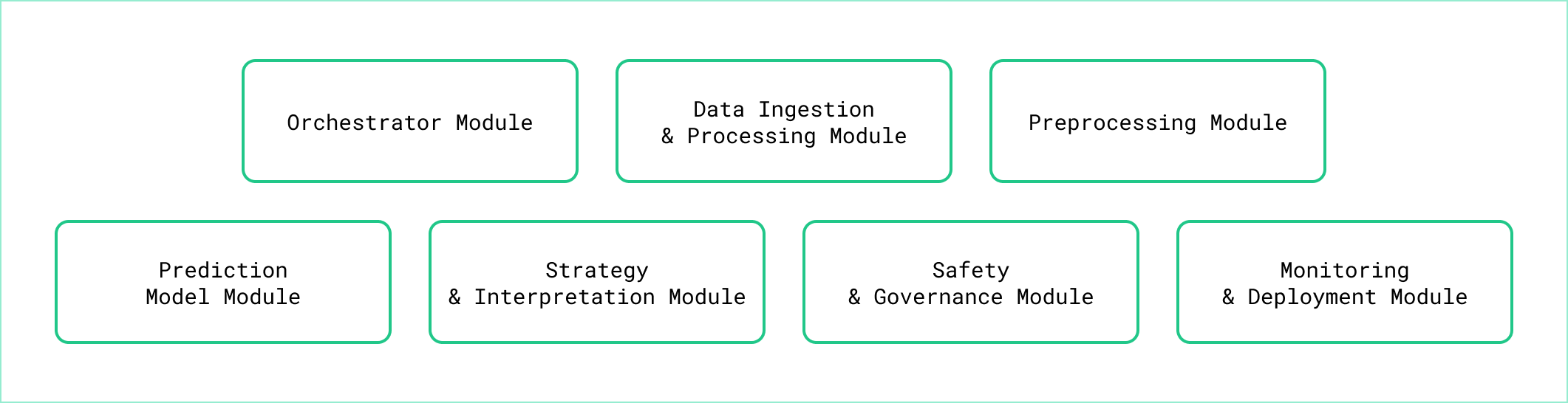

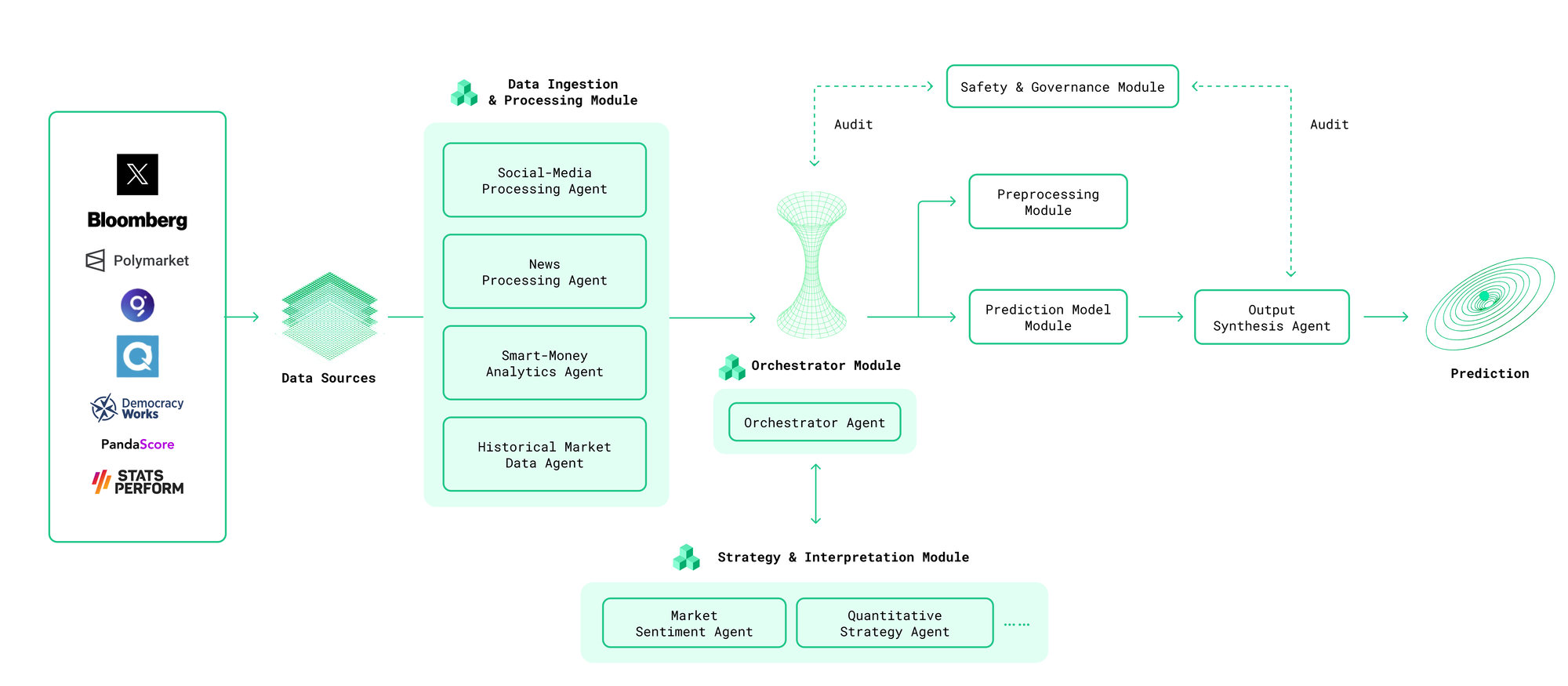

Its architecture adopts a highly modular multi-agent design coordinated by a central Orchestrator Agent. All agents follow a consistent and extensible framework, enabling plug-and-play integration across different prediction-market types and allowing specialized agent modules to be tailored to diverse event scenarios. This modularity ensures rapid adaptation, flexible scaling, and seamless support for new Yala agent components.

- Orchestrator Module: Hosts the Orchestrator Agent, which coordinates all AI agents, manages task routing, merges signals, and ensures coherent end-to-end processing. The Orchestrator also supports plug-and-play integration of different Yala modular agent components, enabling rapid deployment and extension of new agent types.

- Data Ingestion & Processing Module: Includes the Social-Media Processing Agent, News Processing Agent, Historical Market Data Agent, and Smart-Money Analysis Agent, collectively responsible for collecting raw data from Twitter/X, news sources (e.g., Bloomberg), market APIs, and smart-money flows.

- Preprocessing Module: Aggregates, cleans, normalizes, and temporally aligns all multi-source features into a unified model-ready representation.

- Prediction Model Module: Uses an ensemble of LSTM, Transformer, and other time-series models to generate probability forecasts and risk-neutral fair-value estimates based on the unified feature space.

- Strategy & Interpretation Module: Includes the Quantitative Strategy Agent, Market Sentiment Agent, and Output Synthesis Agent, turning model outputs and signals into interpretable, strategy-ready insights.

- Safety & Governance Module: Hosts the Safety & Governance Agent, which enforces rules, applies safety constraints, and ensures compliant behavior across all agents and decision flows.

- Monitoring & Deployment Module: Tracks system performance, manages periodic retraining, and exposes the overall system via API endpoints for integration and automation.

This phase also introduces a full suite of backtesting and risk-control systems, as well as strategy-plugin slots for additional trading heuristics and extensions.

During this period, Yala also plans to release MCP-compatible APIs for programmatic fair-value queries, alongside lightweight bot interfaces on Telegram and/or X.

Future enhancements may include:

- Options-implied volatility (IV) factors

- On-chain capital flow and liquidity signals

- Bayesian dynamic belief updating

- A calibration engine for probability confidence scoring

- Additional factor-based signals integrated into the fair-value model

This transition elevates Yala from simply generating forecasts to delivering a validated fair-value agent, one whose outputs are continuously measured, refined, and improved through real-world feedback and live performance data.

Late Stage: The Multi-Agent Fair-Value System

In the late stage, Yala will evolve into a comprehensive mutli-agent fair-value system capable of evaluating outcomes across markets, signals and event types. The single-agent architecture of the mid stage expands into a coordinated swarm framework in which a Supervisor Agent orchestrates a suite of specialized Worker Agents to generate explainable fair-value analysis.

With expanded capabilities, users can provide broader and more flexible inputs:

- Any asset or event category, spanning the full prediction-market landscape as well as equities, elections, esports, and macro outcomes

- A future time horizon

Based on these inputs, the system generates a complete probability density function (PDF), a multi-factor fair-value curve integrating both subjective and risk-neutral probabilities, confidence intervals, and distribution shapes. This provides users with a holistic probabilistic understanding of outcomes, far surpassing a single-point estimate.

Compared with the earlier stages, the advanced agent introduces four major capabilities:

- Beyond risk-neutral pricing: In addition to no-arbitrage fair value, the system will generate subjective fair-value estimates that incorporate sentiment, macro factors, and domain-specific context.

- Multi-market scope: Fair-value estimation expands from a single price-prediction market into a broad set of domains, including crypto, equities, elections, interest-rate cuts, legislation outcomes, and sports events.

- Multi-factor intelligence: Instead of relying solely on historical trading data, the advanced agent integrates a range of new factors, such as market sentiment, options data, ETF flows, and macro events.

- A multi-agent swarm architecture: The system adopts a layered, collaborative structure in which a Supervisor Agent coordinates a set of specialized Worker Agents.

At the top level, the Supervisor (Orchestrator) Agent coordinates the entire multi-agent system. It parses user queries, assigns tasks to specialized Worker Agents, monitors execution progress, and aggregates all intermediate outputs into final probability and fair-value estimates. Under its coordination, the system deploys several Worker Agents, including:

- Fair-Value Modeling Agent: Selects and applies the appropriate valuation framework risk-neutral, statistical, or subjective based on event characteristics and available signals.

- Data Collection Agent: Continuously retrieves structured market data across historical and real-time sources, integrating price series, volume, order-flow, and related market features.

- Sentiment Analysis Agent: Processes social-media and news signals, quantifying narrative dynamics and sentiment shifts to generate adjustment factors for valuation models.

- Smart-Money Analysis Agent: Identifies informed trading patterns such as Polymarket front-running behavior and high-conviction smart-money flows, producing directional confidence signals.

- Event Tracking Agent: Detects macro shocks, geopolitical events, regulatory updates, and other catalysts that significantly alter probability paths or regime conditions.

- Options Analysis Agent: Computes implied probabilities and volatility adjustments derived from IV surfaces, skew, open-interest ratios, and other options-market indicators.

- Simulation Agent: Runs Monte Carlo or scenario-based simulations to construct baseline probability distributions and explore alternative market regimes.

- Decision Aggregation Agent: Integrates outputs from all Worker Agents, including model forecasts, sentiment scores, smart-money signals, options metrics, and simulations—into consolidated results such as fair-value estimates, probability distributions, confidence intervals, and interpretable explanations.

Together, these agents form a layered, collaborative system for generating rigorous fair-value assessments

The late stage also introduces a trust-minimized, verifiable and community-driven agent environment and the Insider/Private-Information Adjustment Agent, which allows users to securely provide private signals that refine subjective fair values. This agent supports encrypted vector storage and confidential RAG pipelines, offering stronger privacy protections.

Yala will introduce invitation-based or strategy-gated prediction vaults in which advanced agents autonomously allocate capital and take positions on platforms like Polymarket.

Both the full multi-agent system and individual Worker Agents may be monetized or tokenized:

- via x402 paid agent-access models, and

- through agent tokens that entitle holders to a share of agent-generated revenue

These mechanisms enable a decentralized, economically aligned agent ecosystem.

By this point, Yala functions as a fair-value operating system, a coordinated multi-agent environment capable of powering prediction platforms, agent-to-agent economies, and cross-domain forecasting applications. It represents the complete realization of Yala’s vision: a programmable, extensible, and economically aligned system for generating fair-value assessments across the uncertainty landscape.

By the end of the late stage, Yala will become a multi-domain fair-value AI platform ready for scalable, large-scale commercialization.

Updated YALA Tokenomics

In the next phase of Yala’s AI evolution, the YALA token will become the foundational governance and value-alignement asset that powers the entire Yala AI ecosystem. By staking YALA, token holders gain the ability to participate directly in the governance of Yala’s multi-agent architecture, including parameter update, agent-level oversight, and platform-wide decision making.

As new protocol modules and revenue-generating products are introduced, a portion of platform income will be allocated to future YALA buybacks. These revenue streams are expected to come from performance fees originating from fund vaults, as well as usage fees generated when users or developers call Yala’s AI agents. As agent adoption increases, these mechanisms are designed to create sustained, long-term value flow back to YALA stakers.

YALA is also positioned to become the central economic anchor for all tokens issued within the agent network. As new tokens emerge, whether from the broader multi-agent system or from individual Worker Agents, YALA stakers will receive distributions and airdrops tied to these expansions. This model ensures that long-term YALA participants capture the upside of the entire agent ecosystem as it grows, diversifies, and launches new tokenized modules.

Looking Forward

A fair-value agent transforms prediction markets from betting venues into structured, information-pricing systems. With a trustworthy probabilistic signal, markets can price uncertainty more efficiently, liquidity providers can operate with clarity, and users gain a dependable reference point for navigating complex events. Fair value becomes the shared language that aligns participants, agents, and applications across the prediction economy.

This is the world Yala is building toward: a fair-value engine that supports multi-agent coordination, cross-domain forecasting, and. As the system develops, Yala will integrate with a broader ecosystem, agent deployment and tokenization frameworks, MCP-compatible data providers, secure execution environments, and prediction markets that benefit from deeper liquidity and more accurate pricing.

The prediction economy is forming.

Join us as we launch the next chapter of Yala.