Inside Yala’s Roadmap: Building a Fair Value Intelligence Network, Stage by Stage

This article outlines Yala’s multi-stage roadmap, explaining why the platform is being built incrementally, from early fair value signals to a full multi-agent probabilistic system, and how each phase de-risks the next.

Yala is building what prediction markets are missing: a consistent, accessible fair value reference for probability pricing.

But fair value isn’t something you release once and call done. It’s something you construct progressively, validating each step through measurement.

This article outlines Yala’s multi-stage roadmap, explaining why the platform is being built incrementally, from early fair value signals to a full multi-agent probabilistic system, and how each phase de-risks the next.

Why Fair Value Systems Must Be Built in Stages

Most software allows you to ship version one and iterate. In probability systems, you don’t get that luxury.

Prediction markets surface collective intelligence, but they don’t automatically create a stable reference for fair value. In practice, prices can drift, not because markets “fail,” but because they operate under constraints: liquidity thins, narratives cascade, information is uneven, and timing effects can dominate short horizons. Without a calibration discipline, probability pricing becomes inconsistent across categories and environments.

Yala builds in stages to make calibration measurable. Each phase has clear objectives, operates within a defined risk envelope, and validates the assumptions of the previous one before advancing.

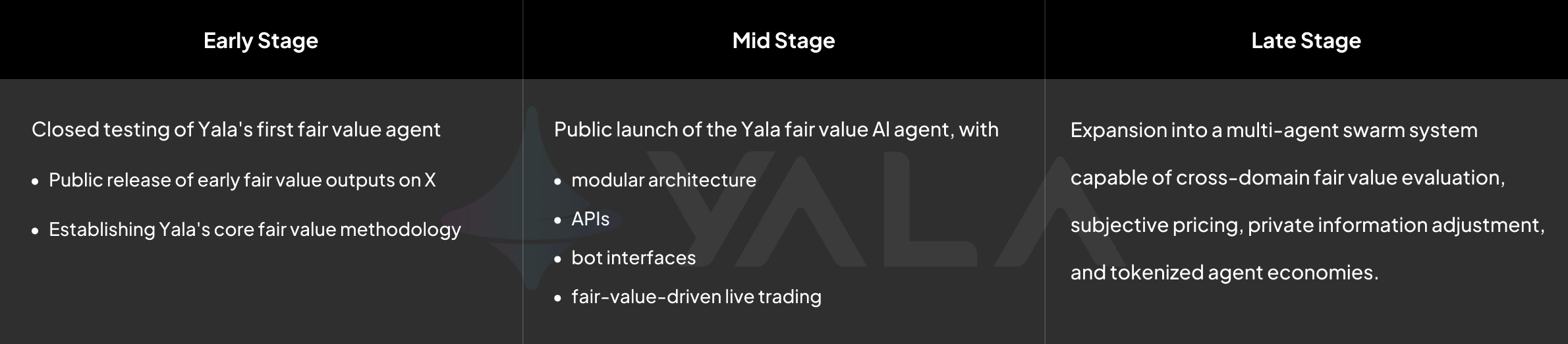

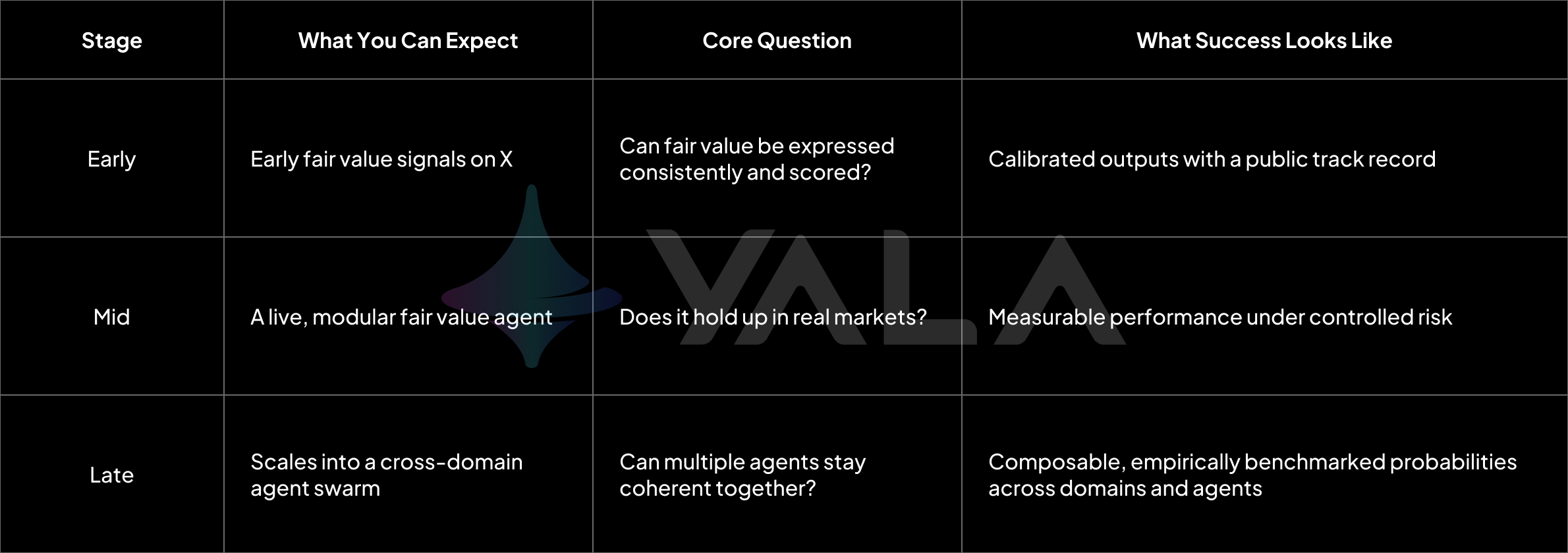

Early Stage: Methodology, Calibration, and Public Signals

The early stage focuses on establishing the foundations of fair value estimation. Yala conducts closed internal testing of early fair value estimation systems, generating probability outputs that are refined and evaluated before full autonomous agent deployment. During this phase, Yala also publishes a steady stream of probability signals through its official X account.

These signals are published primarily as methodological outputs: they make Yala’s fair value approach observable and scorable over time, before full agent deployment. By allowing these signals to resolve against real-world outcomes over time, the system builds an observable validation surface.

At this stage, Yala answers a narrow but essential question:

Can fair value be expressed consistently, so it can be measured, scored and improved?

This must be resolved before live trading and capital deployment become part of the validation loop.

Mid Stage: Autonomous Agents, Live Validation, Controlled Capital

If the early stage proves fair value can be expressed, the mid stage asks a harder question:

Can it hold up in real markets, under incentives?

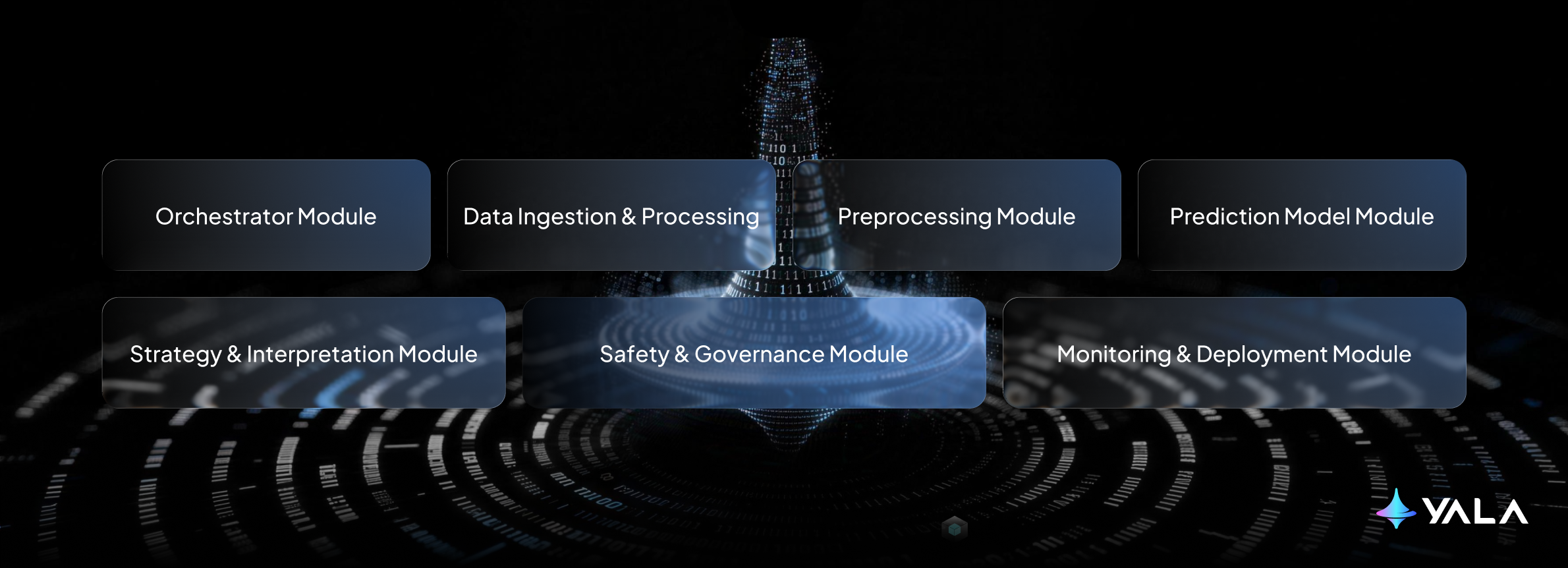

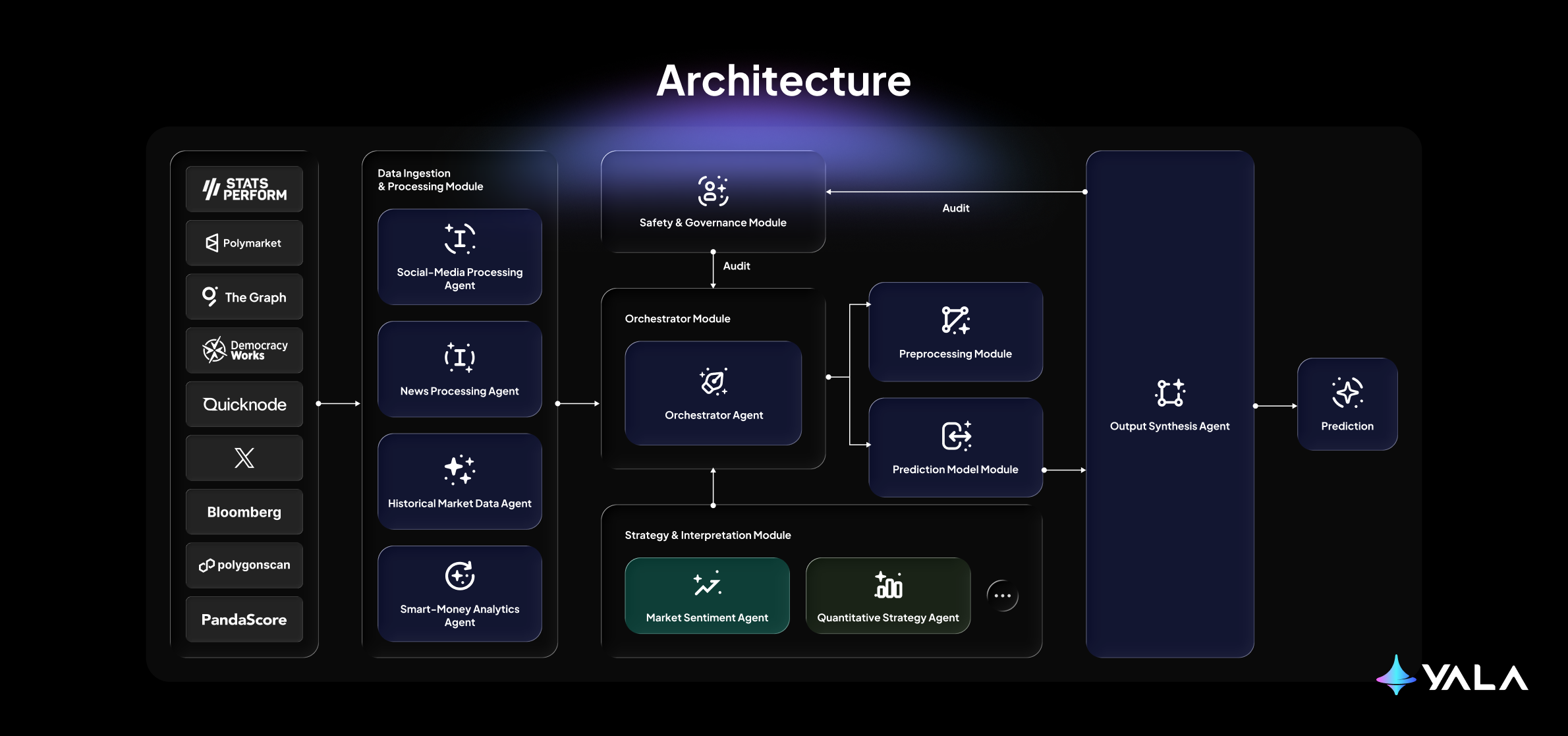

This phase marks the public launch of Yala’s first fair value AI agent. As the system matures, Yala moves from publishing probability outputs to operating a live, empirically verifiable fair value agent designed for price prediction markets and risk-neutral valuation. The agent incorporates historical trading data alongside complementary signals such as news, smart-money flows, and sentiment, and operates under controlled market conditions.

Mid stage introduces the modular architecture: APIs, bot interfaces, and plug-and-play components, so fair value queries can be used across surfaces and extended across market types. It also introduces fair-value-driven live trading in a controlled environment, with intentionally limited capital to validate logic while enforcing strict risk constraints.

By the end of this stage, fair value is no longer a signal stream. It becomes a measurable agent behavior, continuously scored and refined through live market feedback.

Late Stage: Multi-Agent Systems and Cross-Domain Forecasting

Mid stage validates a single fair value agent. The late stage expands the design space:

Can fair value scale across domains, and across agents, without losing coherence?

In the late stage, Yala evolves into a multi-agent swarm system capable of cross-domain fair value evaluation. The system moves beyond a single valuation lens by coordinating specialized agents that contribute different perspectives: market structure, narrative dynamics, smart-money behavior, and other domain-specific signals, and aggregating them into unified probabilistic outputs.

Scope expands in four directions that matter most for the roadmap:

1/ From risk-neutral to subjective fair value, integrating contextual intelligence.

2/ From narrow market coverage to cross-domain forecasting.

3/ From single-point estimates to richer probabilistic structures with distributions and confidence intervals.

4/ Toward privacy-aware, tokenized agent economies that use calibration and resolution as proof of validity.

At this stage, fair value is no longer evaluated as a single agent’s behavior, but as a system-level capability: a probabilistic backbone that markets, agents and users can coordinate on.

Measuring Success Across Stages

As Yala evolves from a single agent into a multi-agent system, complexity grows faster than certainty. At that point, the question is no longer what the system can explain, but how it can be evaluated.

Narratives can justify assumptions, but measurement enforces discipline. Calibration, scoring, and live benchmarking turn probability outputs into something the market can continuously audit. With measurement, complexity becomes intelligence.

Yala’s long-term vision is to build fair value intelligence agents for prediction markets: a reliable, accessible probability reference that improves decision quality, reduces information inequity, and enables coordination around verifiable signals.

- Early stage succeeds when probabilities are stable, calibrated, and publicly testable over time.

- Mid stage succeeds when the agent is verifiable in real markets under controlled risk, with measurable performance.

- Late Stage succeeds when multiple agents can be coordinated into coherent cross-domain fair value outputs, and when the system can scale without losing verifiability.

Fair value is the reference point every rational market needs.

Yala’s mission is to make that reference programmable, empirically testable, and accessible.