Euler Joins the Yala DeFi Marketplace: Supply, Loop & Earn with Boosted Berries

Euler, a leading Ethereum-native lending protocol, is now active on the Yala DeFi Marketplace.

GM Yetis,

We’re excited to announce the integration of Euler, a leading Ethereum-native lending protocol, into the Yala DeFi Marketplace.

With Euler now live, $YU holders can earn yield and boosted Berries rewards by supplying USDC or $YU directly on Ethereum, helping power the PT-YU market while enjoying leveraged returns.

Whether you’re sitting on idle USDC or looking to put your $YU to work, Euler offers a safe and capital-efficient way to earn, in line with Yala’s mission to deliver diverse yield opportunities for Bitcoin users.

Start earning on Euler now: https://app.yala.org/defi-marketplace

Full Guide: https://docs.yala.org/user-guide-mainnet/earn#defi-marketplace

Why Euler

Euler is one of Ethereum’s most advanced lending platforms, enabling users to deposit, borrow, and build sophisticated DeFi strategies using non-custodial smart contracts.

With a flexible vault system and composable yield mechanics, Euler is the perfect partner for Yala to scale BTC-backed liquidity on Ethereum. To strengthen the pt-YU liquidity loop, Yala is introducing targeted incentives for users.

At its core, Euler lets users:

- Lend with control: Earn interest by supplying assets to open markets while managing your own risk.

- Borrow flexibly: Use crypto assets as collateral to access capital with adjustable risk settings.

- Build with tools: Create custom lending products or integrate with other DeFi protocols using Euler Vaults.

How It Works in the Yala DeFi Marketplace

Just like our other integrations (Pendle, Kamino, RateX), Euler Vaults are fully accessible from the Yala DeFi Marketplace ,no app switching or wallet juggling required.

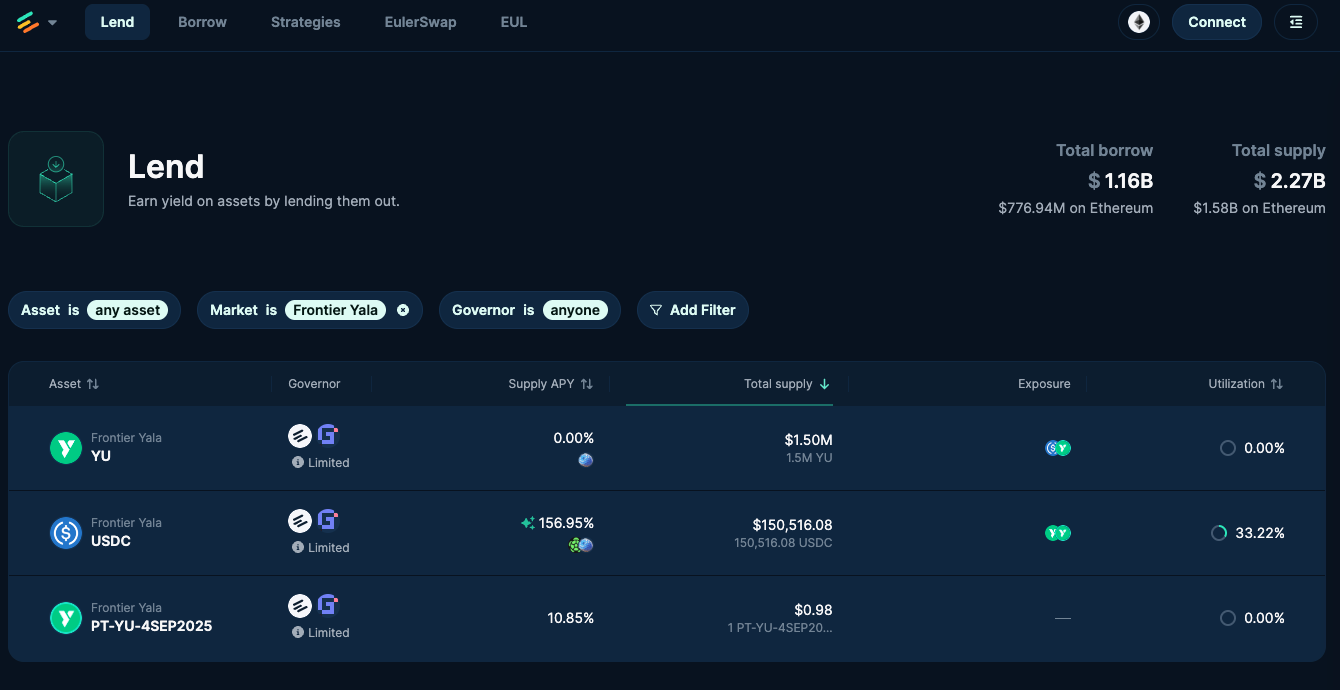

Supply USDC: Earn 5x Berries/hour

Supply USDC into Euler’s designated lending pool to support pt-YU borrowers. With the base reward rate of 0.05 Berries per unit, you’ll earn a 5x multiplier while providing essential stablecoin liquidity.

Supply $YU: Earn 3x Berries/hour

Deposit your $YU into Euler’s $YU pool to earn lending yield and 3x Berries/hour.

Loop & Leverage: Maximize PT-YU Yield and Berries

PT-YU already offers attractive implied yields on Pendle. By using Euler, you can take it a step further—leveraging PT-YU to amplify both returns and Berries.

Supply PT-YU as collateral on Euler to borrow $YU, then use that $YU to buy more PT-YU on Pendle. Repeat the loop to build a capital-efficient position with boosted yield exposure and Berries rewards throughout.

Note: Staking PT-YU itself does not earn Berries rewards.

A Stronger Yield Layer for Bitcoin

By minting $YU, users gain a versatile, cross-chain asset that seamlessly connects to protocols like Euler, Pendle, Kamino, and RateX, unlocking access to diverse, capital-efficient strategies on Ethereum, Solana, and beyond.

Start lending today and multiply your role in the future of decentralized yield.

→ Activate Euler strategy on Yala: https://app.yala.org/defi-marketplace

Join the Yala Community

Yala is a native Bitcoin liquidity protocol that channels BTC into yield opportunities across DeFi and RWAs.

Bitcoin holders unlock capital through self-custodial, liquidation-free borrowing by minting $YU, a BTC-backed liquidity asset. In this process, they pay a stability fee directly to $YU depositors, effectively exchanging BTC-backed exposure for portable, capital-efficient liquidity and access to yield without giving up ownership.

Yala’s SmartVault module manages system risk and ensures efficient yield distribution.