DeFi Yields with Yala: How To Guide

This guide will walk you through the key ways to earn with $YU on the Yala mainnet.

Welcome to Yala - your bridge between Bitcoin and the world of DeFi yields.

The process is simple: Mint $YU - the Yala Bitcoin-backed stablecoin - and put it to work. If you’ve already minted $YU, you’re well on your way. If not, start here to earn real yield and stack Berries.

This guide will walk you through the key ways to earn DeFi yields with $YU on Yala mainnet.

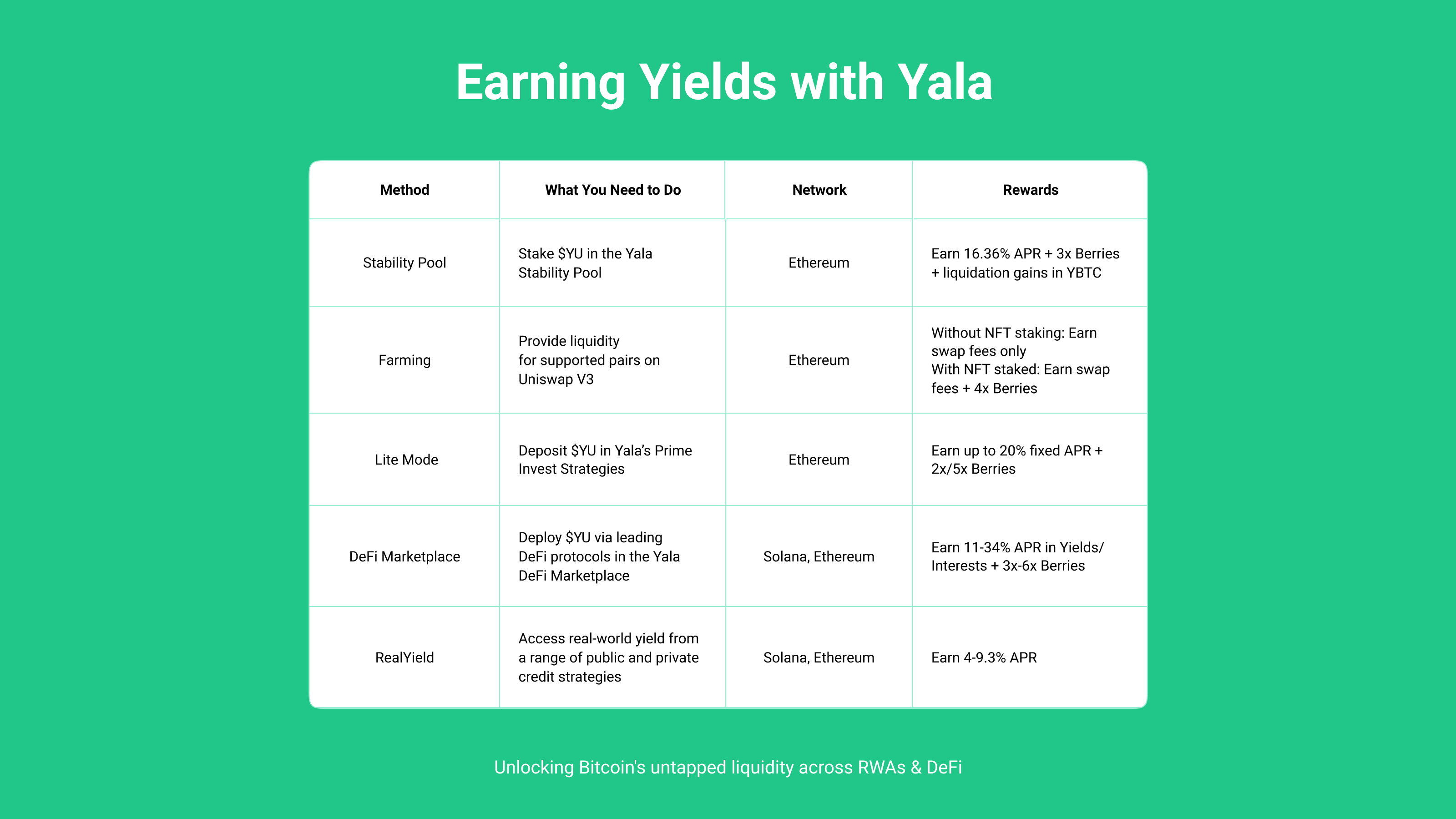

Overview: Earning with Yala

Let’s walk through each of these step-by-step.

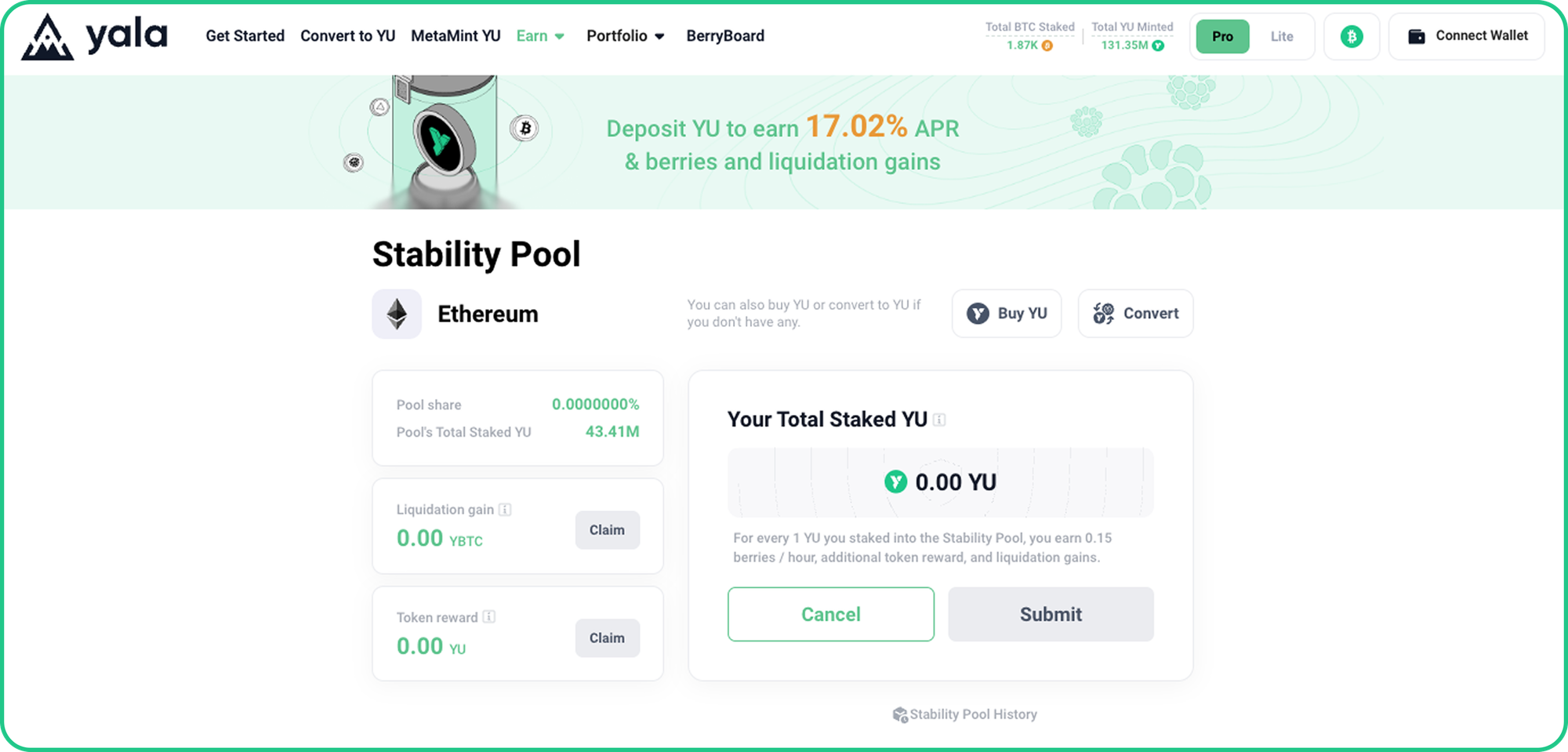

1. Stability Pool

Secure the Yala protocol and earn yield in return.

When you stake your $YU in the Stability Pool, your $YU is used to absorb liquidated debt. In exchange, you receive liquidation gains in YBTC and bonus $YU rewards. In many cases, these rewards can offset or even exceed your original stake.

How to stake in the Yala Stability Pool:

- Go to Earn → Stability Pool

- Enter amount of $YU to stake

- Click 'Stake' and confirm in your wallet

Note: Make sure you have $YU in your wallet. If not, you can Convert from USDC with no slippage or Buy $YU from a DEX.

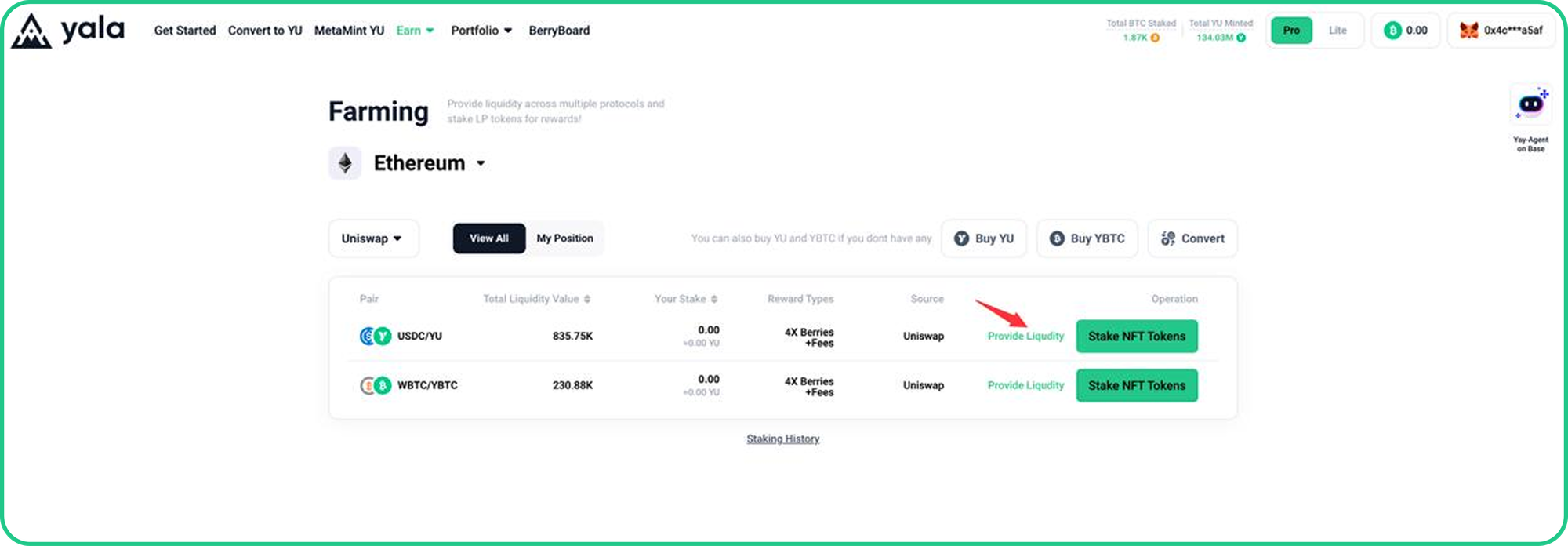

2. Yield Farming

Fuel the Yala ecosystem and earn rewards. Provide liquidity for supported pairs (like YU/USDC or YBTC/WBTC) on Uniswap V3 to earn swap fees and stack Berries as bonus rewards.

Start farming in 3 steps:

- Step 1 – Choose a Pool

- Go to Earn → Farming

- Choose from available pools (e.g. YU/USDC, YU/WBTC)

- Click "Provide Liquidity."

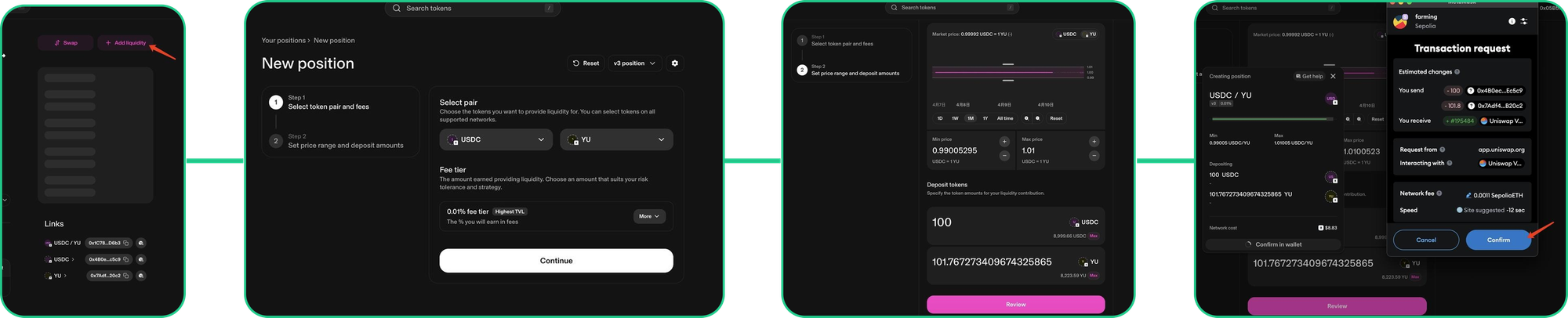

Step 2 – Add Liquidity on Uniswap V3

- Make sure you’re on Uniswap V3, using the 0.01% fee tier

- Set a price range between 0.99 – 1.01

- Enter the amount of one asset – Uniswap will auto-calculate the other

- Approve spending and confirm the transaction in your wallet

- Once added, your LP position will appear on Uniswap as an NFT token

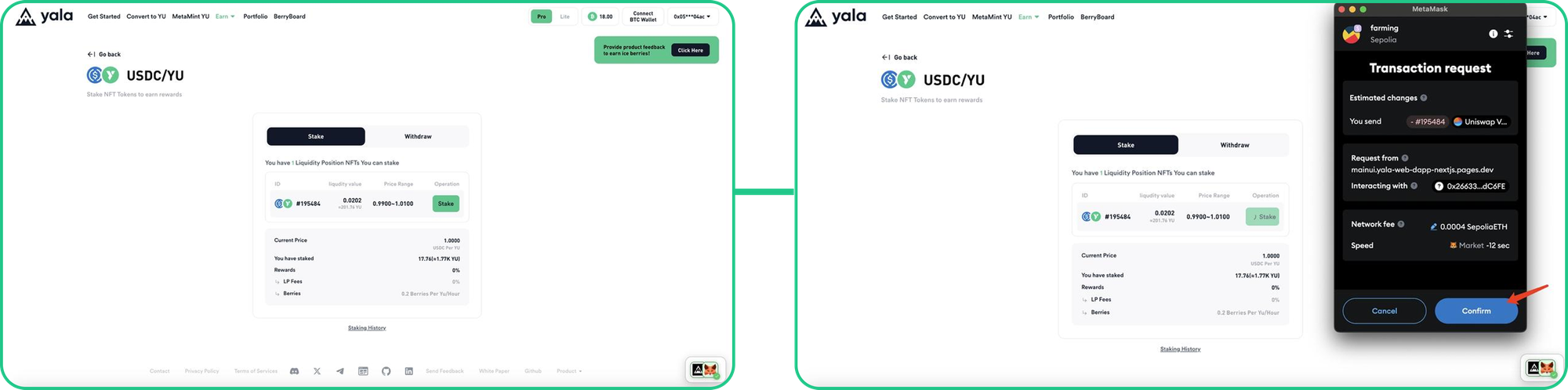

Step 3 – Stake Your NFT Tokens on Yala

- Return to the Farming on Yala

- Click “Stake NFT Tokens”

- Choose the position you want to stake → click "Stake."

- Approve and confirm the transaction in your wallet

Reminder:

- If you only hold NFT Tokens, you’ll earn swap fees.

- If you stake them on Yala, you’ll earn swap fees + Berries (Yala ecosystem & airdrop points.

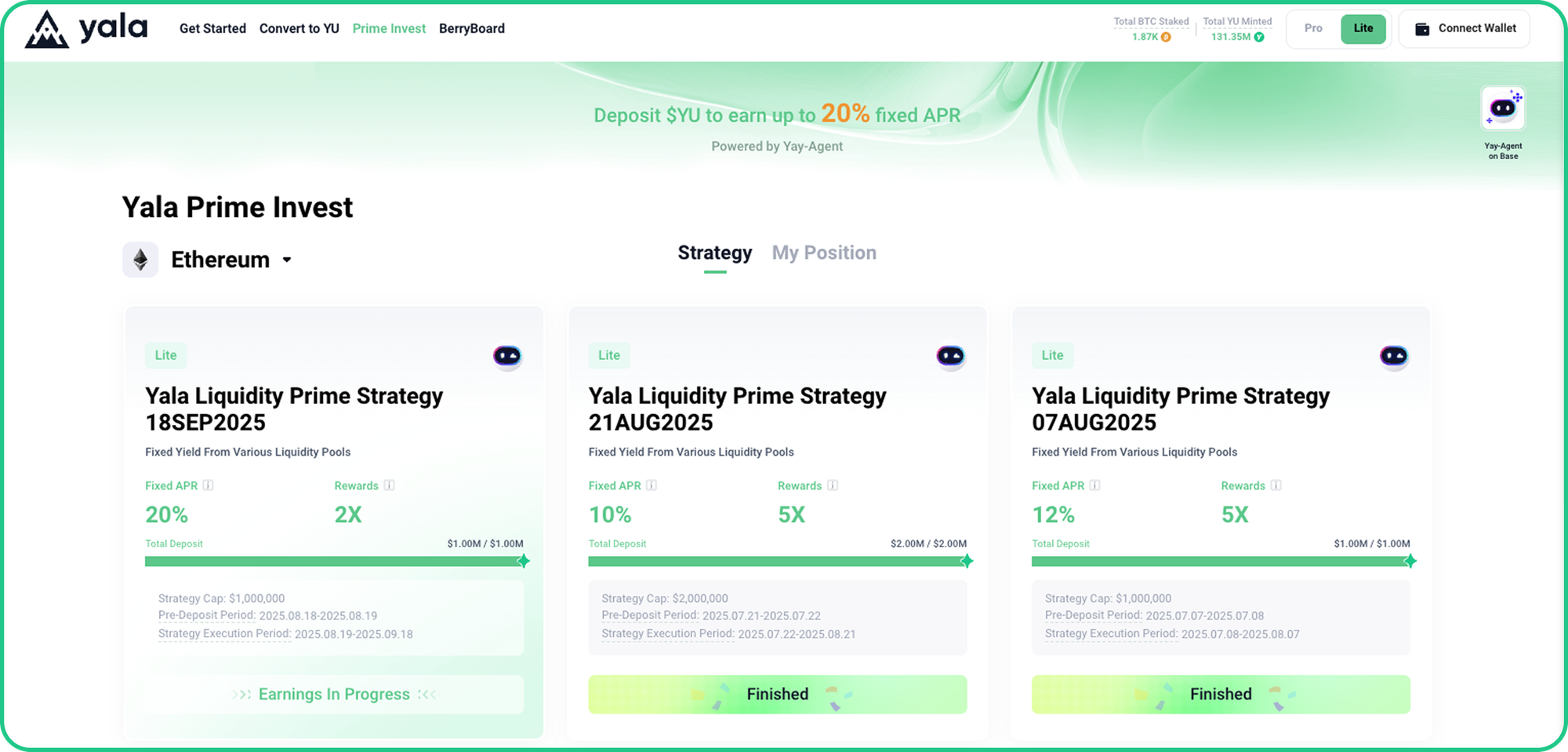

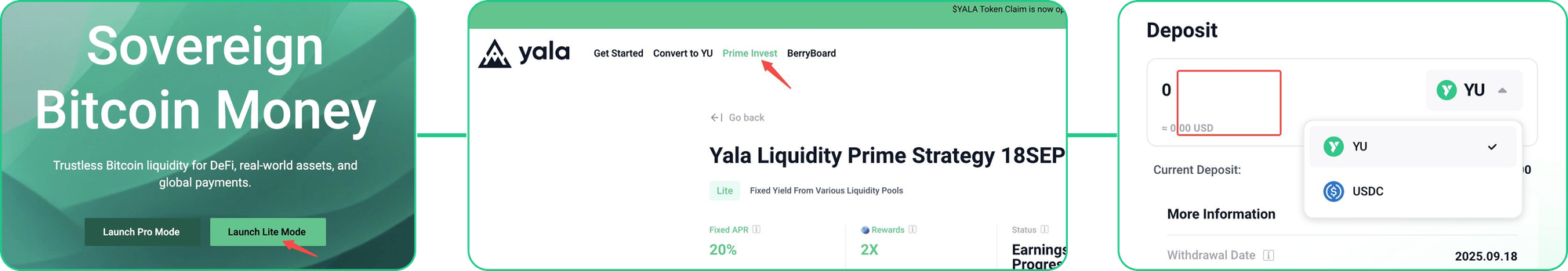

3. Deposit with Lite Mode

Put your $YU to work effortlessly.

Deposit your $YU or USDC into Lite Mode and earn 2x-5x Berries plus up to 20% fixed APR. All managed securely in the Yala Vault.

How to deposit:

- Go to yala.org → select “Lite Mode" and connect your wallet.

- Click “Prime Invest” → enter the amount you want to deposit.

- Confirm the transaction in your wallet.

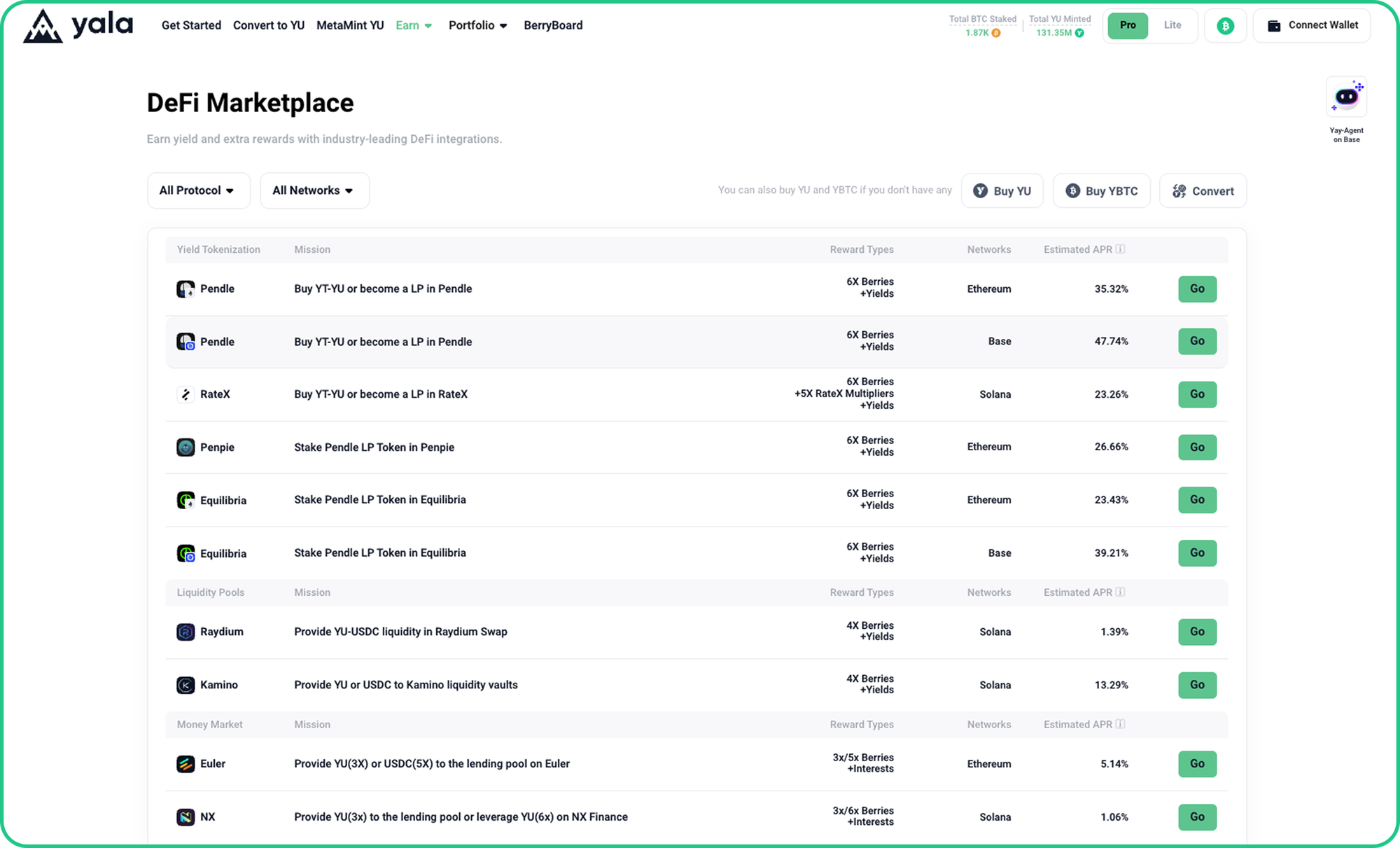

4. Explore the DeFi Marketplace

Looking for more ways to earn? The Yala DeFi Marketplace lets you deploy $YU across multiple chains and top protocols, unlocking yields and 3x-6x Berries all in one hub.

To Get Started in the DeFi Marketplace

- Visit the DeFi Marketplace: app.yala.org/defi-marketplace.

- Select a protocol you want to interact with (e.g., Pendle, Kamino, Raydium, RateX, Penpie, Equilibria, Euler and/or NX Finance).

- Review the mission and rewards (APR, Berries multiplier, extra incentives).

- Click “Go” next to your chosen protocol.

- Connect your wallet and follow the instructions (buy, stake, or provide liquidity).

- Confirm the transaction in your wallet.

For step-by-step tutorials on each protocol, visit here.

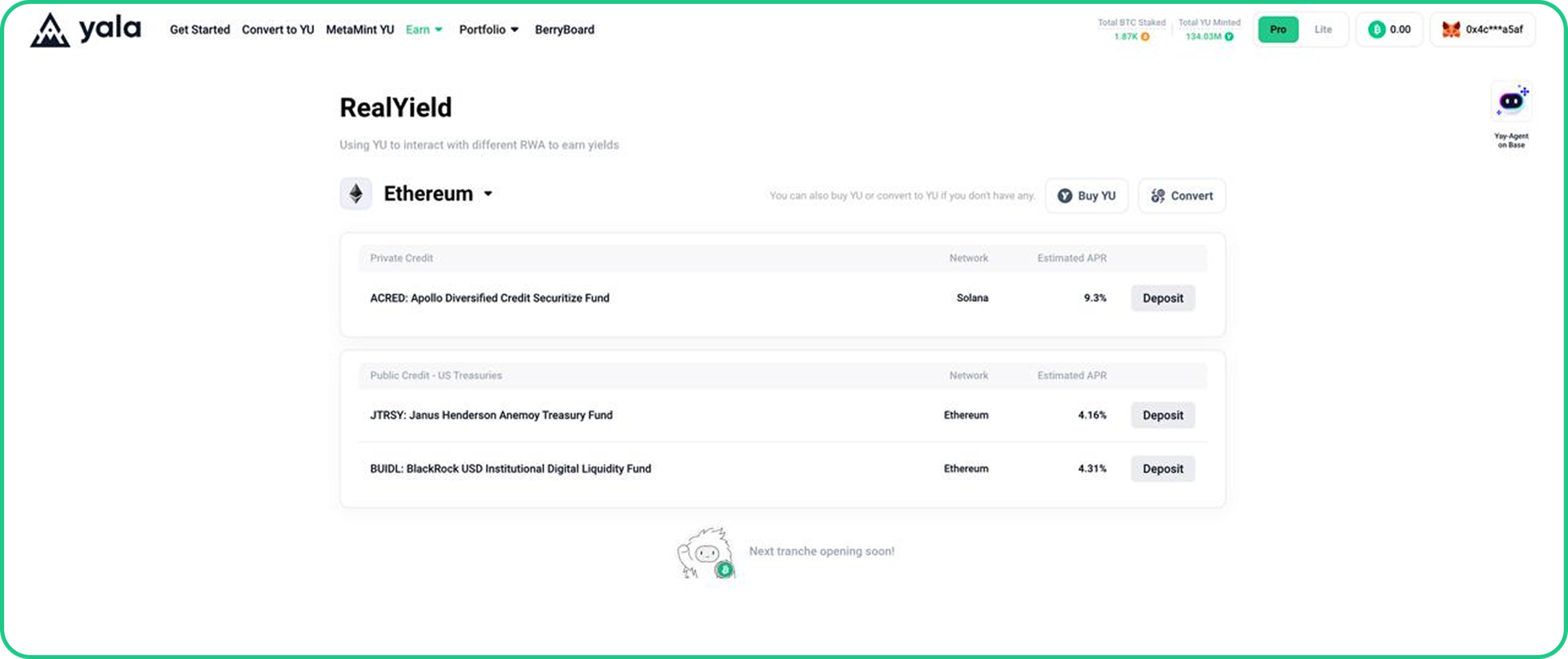

5. Earn RWA Yields with Yala RealYield

Access real-world yield from a range of public and private credit strategies, earning 4 – 9.3% APR through platforms like BUIDL (BlackRock) and JTRSY (Centrifuge) for public credit backed by U.S. Treasuries, and ACRED (Apollo Securitize Fund) for private credit exposure.

Bookmark this blog. More ways to earn with Yala are on the way.

Join the Yala Community

Yala is a native Bitcoin liquidity protocol that channels BTC into yield opportunities across DeFi and RWAs.

Bitcoin holders unlock capital through self-custodial, liquidation-free borrowing by minting $YU, a BTC-backed liquidity asset. In this process, they pay a stability fee directly to $YU depositors, effectively exchanging BTC-backed exposure for portable, capital-efficient liquidity and access to yield without giving up ownership.

Yala’s SmartVault module manages system risk and ensures efficient yield distribution.