Bitcoin & Real World Assets (RWAs): A New Era for BTC Utility

By abstracting complexity and partnering with regulated infrastructure, Yala makes BTC a gateway to decentralized, yield-bearing capital markets. This isn’t just RWAs on Bitcoin. It’s Bitcoin unleashed.

TLDR

Yala transforms Bitcoin from passive “digital gold” into a sovereign financial primitive powering global yield. Through $YU, users can earn sustainable yield via real-world assets such as U.S. Treasuries and private credit. By abstracting complexity and partnering with regulated infrastructure, Yala makes BTC a gateway to decentralized, yield-bearing capital markets. This isn’t just RWAs on Bitcoin. It’s Bitcoin unleashed.

Bitcoin’s Evolution: From Digital Gold to Yield-Bearing Asset

For over a decade, Bitcoin has served primarily as a non-sovereign store of value—powerful in principle, but inert in practice. Yala is redefining that utility.

By enabling BTC holders to collateralize their assets and mint $YU—a decentralized stablecoin pegged to the U.S. dollar—Yala opens the door to sustainable, real-world yield. Instead of liquidating Bitcoin to participate in DeFi or traditional markets, users retain exposure to BTC while deploying its value productively.

This is Bitcoin as it was originally envisioned: not just a speculative asset, but a functioning component of global financial infrastructure.

RWAs: The Bridge Between Traditional Finance and DeFi

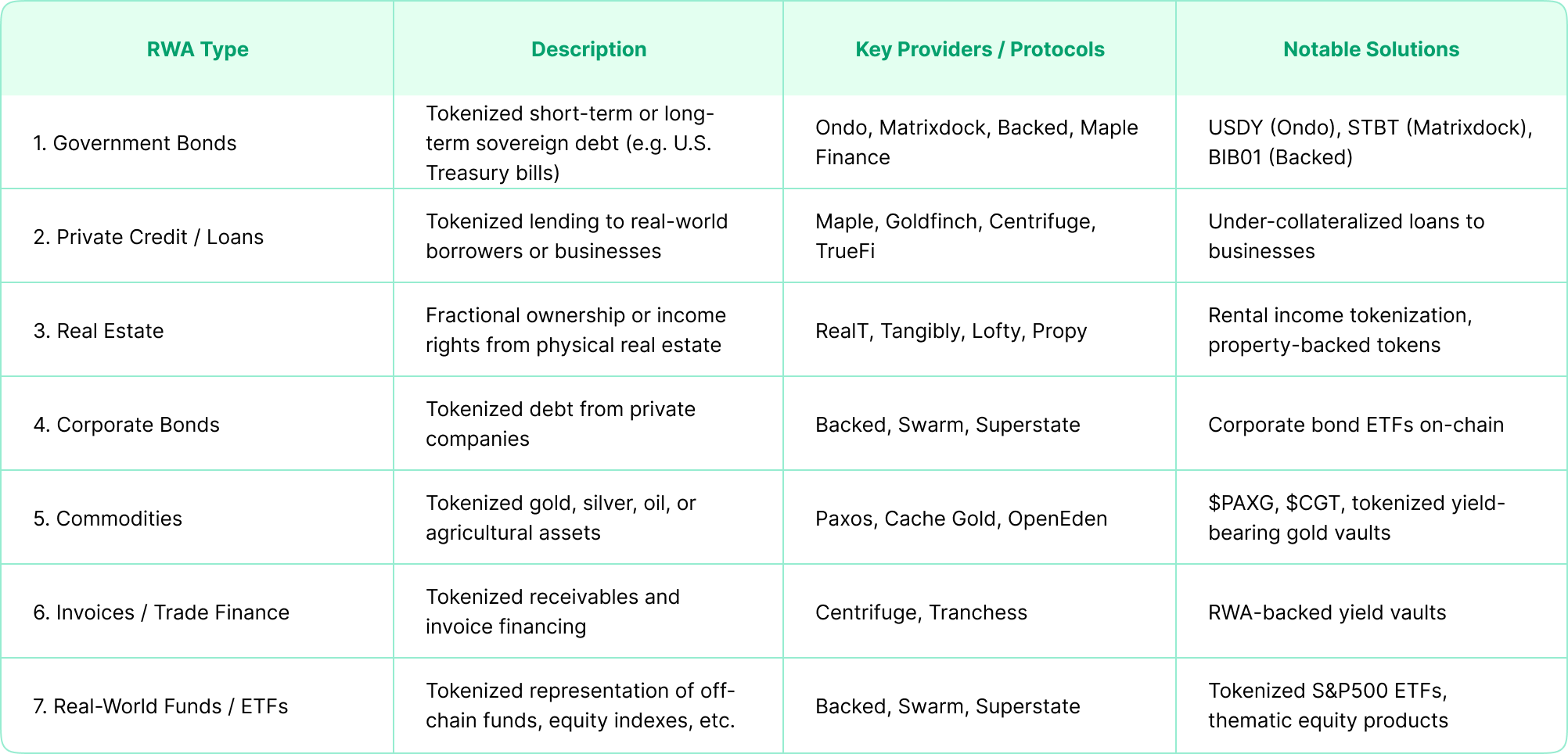

Real-World Assets (RWAs) represent the tokenization of traditional financial instruments—bonds, treasuries, real estate, private credit—into on-chain formats. This enables direct, permissioned access to historically inaccessible yield products.

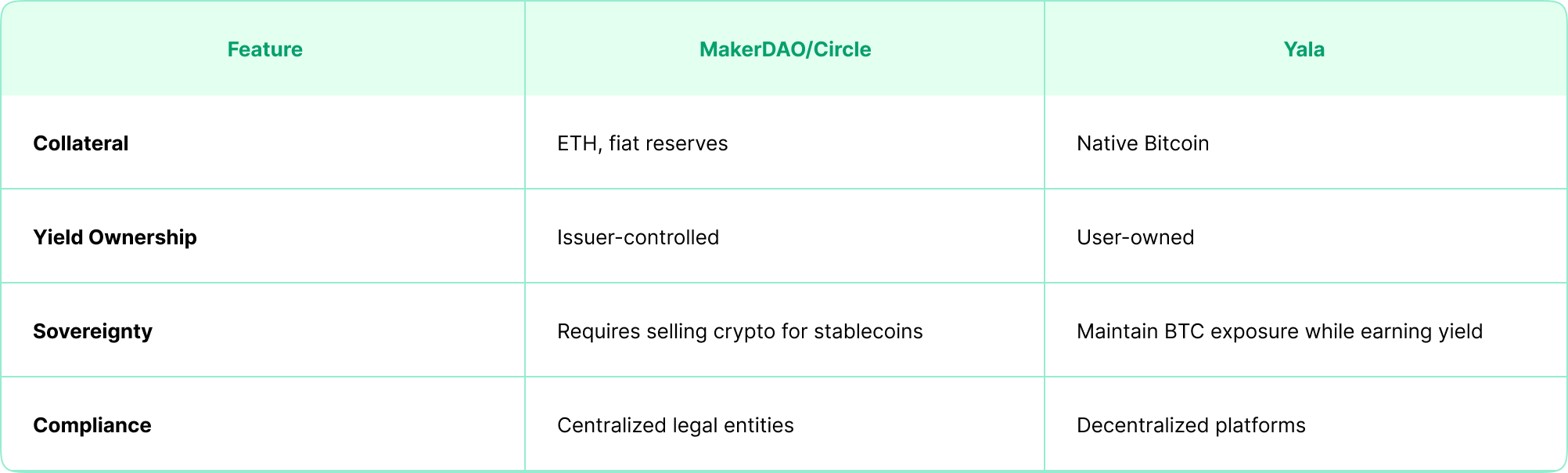

MakerDAO was among the earliest to integrate RWAs into its collateral base, using legal wrappers and SPVs to bring off-chain capital into DeFi. Circle’s USDC and BlackRock’s BUIDL fund extended this concept further, giving users stablecoin access to institutional yield products.

But until now, Bitcoin has remained excluded from this evolution. Not because of lack of demand, but because of a lack of infrastructure.

Yala’s RWA Framework: Bringing Bitcoin into the Real Economy

Despite Bitcoin’s $1.6 trillion market cap and growing macro relevance, BTC has been largely absent from RWA markets due to three core challenges:

- Regulatory Compliance: Bitcoin’s pseudonymity limits its direct access to KYC/AML-compliant systems.

- Volatility: BTC’s price fluctuations require stable settlement layers for yield-bearing assets.

- Fragmentation: BTC liquidity exists in silos—wrapped assets on Ethereum, Layer 2s, and bridges—each with unique trust assumptions.

Yala solves these challenges head-on. Using its MetaMint Protocol, Yala aggregates BTC liquidity across multiple wrapped standards (e.g., WBTC, tBTC, sBTC) to mint $YU. This creates a deep, composable liquidity pool centered around Bitcoin—one that is fully interoperable with on-chain RWA platforms.

Partnering with institutional-grade RWA providers, Yala abstracts the regulatory and custodial complexity while allowing users to remain decentralized. Compliance, legal wrappers, and asset custody are handled under the hood—leaving users with a seamless, permissioned on-ramp to real-world yield.

Yala RealYield: The New RWA Standard for Bitcoin

RealYield, as enabled by Yala, refers to yield derived from actual, revenue-generating real-world assets—not inflationary token incentives. Through $YU, users gain access to structured yield products such as tokenized U.S. Treasuries, private credit, and other fixed-income assets that pay out real cash flows.

Unlike many DeFi protocols where yield is subsidized by governance token emissions, Yala’s model directs income from underlying assets back to users. This means $YU holders earn predictable, sustainable returns tied to real economic activity.

- Sovereign Collateral: $YU is minted against Bitcoin, not fiat. This preserves decentralization while unlocking yield.

- User-Aligned Yield: Yield from RWAs is routed directly to users—not protocol treasuries or centralized issuers.

- Dual Exposure: BTC holders mint $YU to earn RWA yield without selling their Bitcoin. Trillions in dormant capital are now productive.

- Modular Marketplace: Users can allocate $YU across a growing menu of tokenized assets, strategies, and durations—from T-bills to private credit.

- Trusted Partnerships: Yala collaborates with regulated RWA issuers to ensure compliance, enforceability, and asset quality—without compromising on decentralization.

Additionally, Yala’s architecture allows users to layer yield strategies—staking BTC to earn protocol-level rewards, while simultaneously deploying $YU into RWA-based vaults. This dual-layered approach turns idle BTC into a productive asset without compromising decentralization.

RealYield isn’t just a financial feature—it’s a structural advantage. It aligns with Bitcoin’s ethos of transparency, security, and durability, while delivering tangible, risk-adjusted returns in today’s evolving crypto-financial landscape.

The Role of $YU: Bitcoin’s Liquidity Layer

$YU isn’t just a stablecoin—it’s a settlement and trading layer for Bitcoin in the broader RWA economy. Designed for maximum capital efficiency, it allows Bitcoin liquidity to move across chains, yield venues, and financial ecosystems.

And with features like self-custody collateral vaults and BTC-native staking through Babylon, Yala ensures that even high-net-worth Bitcoin holders can earn real yield without trust trade-offs.

This makes $YU the financial conduit for Bitcoin in the age of productive capital.

Yala is Bitcoin’s Bridge to Real Yield

The rise of RWAs marks a new frontier in decentralized finance. But without Yala, Bitcoin—the most decentralized, liquid, and widely held asset in crypto—remains sidelined.

Yala changes that. By enabling $YU, Yala gives BTC its long-awaited bridge to institutional-grade yield, regulatory-compliant assets, and multi-chain liquidity.

Bitcoin is no longer just a bet on future value—it is now a working, earning component of the on-chain financial system.

Yala is the protocol making this future possible.

Bitcoin was the beginning. Yala is what’s next.